After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Why MultiChoice is looking to the Rest of Africa for growth

MultiChoice Group has been contending with regulatory, tax, and economic headwinds, particularly in its home market of South Africa but also in the wider subregion. Under current regulations, subscription broadcasting services in South Africa are mandated to carry specific freeto-air channels provided by the public broadcaster South African Broadcasting Corporation (SABC).

MultiChoice Group has been contending with regulatory, tax, and economic headwinds, particularly in its home market of South Africa but also in the wider subregion. Under current regulations, subscription broadcasting services in South Africa are mandated to carry specific freeto-air channels provided by the public broadcaster South African Broadcasting Corporation (SABC).

Pay TV operators have carried the channels for free since 2008, when the Independent Regulatory Authority of South Africa (ICASA) stipulated that they must carry SABC channels that operators, like MultiChoice-owned DStv, previously broadcast without incurring a carriage fee. South Africa’s public broadcaster, already suffering from a lack of license fee income and a downturn in advertising revenue, is facing a battle with MultiChoice Group over the must-carry regulations.

The dispute centers around the amount of advertising income SABC earns from its channels that are available on DStv. SABC and MultiChoice Group reached an impasse in negotiations in November 2022 and have subsequently entered ICASA-led arbitration over the must-carry regulations.

Rising inflation, increasing interest rates, and a weakening rand have raised operating costs for businesses in South Africa and are putting intense pressure on middle-class disposable incomes. This economic environment led MultiChoice Group to issue a warning about future operating margin pressures in its voluntary trading update in March 2023. It has since published its full-year figures, with profits hit by adverse currency impacts and a decision not to pay a dividend in order to invest in streaming service Showmax, among other factors.

Rising inflation, increasing interest rates, and a weakening rand have raised operating costs for businesses in South Africa and are putting intense pressure on middle-class disposable incomes. This economic environment led MultiChoice Group to issue a warning about future operating margin pressures in its voluntary trading update in March 2023. It has since published its full-year figures, with profits hit by adverse currency impacts and a decision not to pay a dividend in order to invest in streaming service Showmax, among other factors.

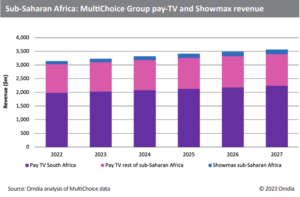

Omdia forecasts modest pay TV subscriber growth in South Africa of just 5.1% between 2022 and 2027 for MultiChoice. These economic woes are compounded by the energy crisis currently gripping South Africa. In response to rolling scheduled power cuts, known as load shedding, MultiChoice Group has created pop-up channels that repeat content to serve its affected subscribers.

Despite the macroeconomic and regulatory headwinds, MultiChoice has shown some resilience and an ability to adjust quickly. Omdia expects positive subscriber growth from Multichoice Group across pay TV and OTT in wider sub-Saharan Africa, with subscriptions forecast to rise from 17.5m in 2022 to 20.2m by 2027.

MultiChoice’s OTT streaming platform, Showmax, has experienced considerable subscriber growth since launching in August 2015, with subscriber numbers across Africa reaching almost 1.7m in 2022. Showmax has been going head-to-head with rival Netflix in South Africa, and Omdia forecasts that its subscribers in sub-Saharan Africa will exceed Netflix’s by 2027. Although other nations in the subregion are not unscathed by the harsh macroeconomic landscape, subscriber and revenue numbers did grow last year, offsetting weaker performance in South Africa.

Consequently, Omdia expects the rest of sub-Saharan Africa, excluding-South Africa, to contribute a growing proportion of MultiChoice’s total pay TV subscriptions, with this share of subscribers forecast to rise from 53.6% in 2022 to 56.4% by 2027.

Samuel Nkwam is research analyst, media and entertainment at Omdia. For more on MultiChoice’s strategy from Omdia, click here.