After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Why hybrid video services will drive streaming growth

As video markets worldwide become increasingly mature and household budgets are increasingly restricted, consumers must make choices about their available video services.

This includes paid subscription video services and free/ advertising-supported options, with consumers having to weigh their tolerance for advertising with the cost of accessing an ad-free option. Bridging this binary gap, however, are hybrid services, which offer a blend of paid access to content with advertising to subsidize the upfront cost, with ad loads typically less than those of purely advertising-supported offerings.

Direct-to-consumer streaming services in the US and increasingly around the world are embracing these hybrid business models, but the question remains as to how consumers will take to the concept of paying for ad-supported video content.

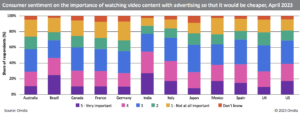

According to Omdia Consumer Research conducted in April 2023 across 12 markets, roughly 1/3 of consumers claim that watching video content subsidized by advertising to make it cheaper is important to them. This ranges from approximately 30% in the UK, Germany, and Japan, to about 40% in Spain, Italy and the US to around 50% in Brazil and India.

Younger age groups

These consumers tend to overindex in younger age groups, with particular emphasis on those aged 25–34, a demographic notorious for being the most highly engaged media consumer group across all markets sampled by Omdia Consumer Research. However, this can vary substantially by country, with these younger consumers being 10–40% more likely to claim advertising-video subsidizing as important than market averages.

Although a significant share of consumers in various markets cite this as important, as a factor influencing people’s interest in video services, it ranks among the lowest of the features studied by Omdia. These other features include original content, 4K/UHD content, and price, the latter of which ranks highest across all markets sampled, with 75–85% of respondents citing it as important. Discrediting these consumers as a minority, however, would be to undersell their value as holistic media and entertainment consumers.

Omdia Consumer Research found that the consumers who cite advertising-video subsidizing as important to them also found other features were highly important at rates well over market averages. These consumers are also more likely to take multiple video services across paid subscription and free/ advertising-supported video services.

These include over twice as many broadcaster video on-demand services, 50–150% more paid video services, and 3–5 times as many FAST services, totaling 30–70% more video services on average. As more video services move to hybrid business models, these above-average consumers will lead the charge in establishing new video service portfolios, offering benefits for consumer affordability and service provider revenue.