After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Research: Disney’s pivot streams into focus

Ed Barton, chief analyst at Ovum, considers the prospects of Disney+ in an increasingly crowded streaming market.

The launch of Disney+ in November represents a critical milestone in Disney’s strategy to lessen its reliance on pay TV and TV advertising by building a direct-to-consumer streaming service. This is no ordinary streaming launch. It will ramp up already intense competition for the global premium video audience and is the culmination of years of preparation involving mollifying established distributor relationships, unwinding rights deals with competing streaming platforms, and ring-fencing investment to produce exclusives for the platform while forgoing, for the time being, the familiar incremental revenue generated for letting other streamers use its content, which we estimate at between US$250 million (€226 million) and US$350 million per annum.

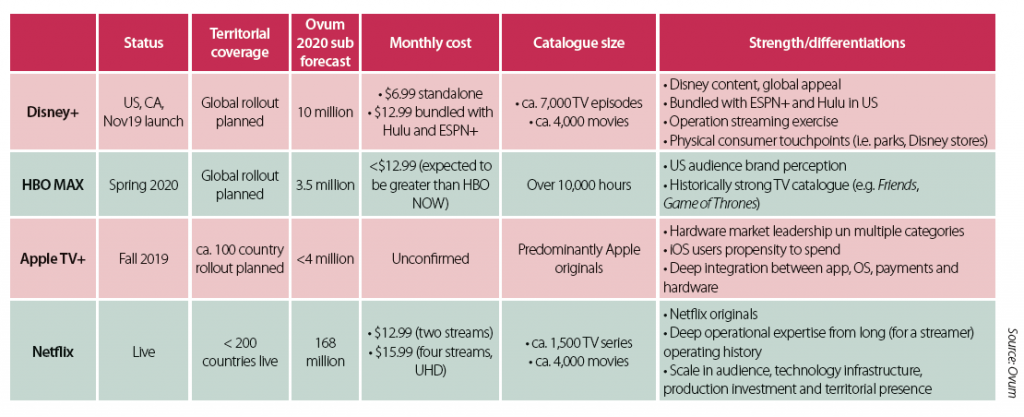

Disney+ is launching at roughly the same time as two other notable streaming service launches: HBO Max and Apple TV+, both of which are also motivated by the impact Netflix has had on practically every aspect of premium video distribution. Ovum believes that Disney’s go-to-market strategy is currently the most compelling, albeit with admittedly incomplete information regarding some of the details of the competing services.

Ovum is currently forecasting that Disney+ will attract some 10 million subscribers globally by end-2020, comfortably exceeding the growth rates we anticipate from Apple TV+ and HBO Max. Our outlook is driven by Disney’s historic strength in producing intellectual property which resonates both globally and across age groups; its willingness to invest in exclusive, original shows and movies; its hard-won expertise in building and managing large-scale streaming platforms through its ownership of MLBAM; its global presence and established relationships with premium TV and video distributors, and the notably aggressive go-to-market strategy revealed for the US launch. Disney’s publicity machine is moving through the gears for a November launch, and the initial reception of trailers for Star Wars spin-off The Mandalorian and Lady and the Tramp is encouraging, with 15 million and 10 million views of the trailers on YouTube, respectively, in three days.

Disney+ also raises the bar for value, with pricing apparently designed to make Netflix look, at best, ordinary. Disney+ offers four simultaneous streams including UHD for US$6.99 a month compared to US$15.99 a month to receive the same from Netflix, and offers UHD streaming with HDR and Dolby Atmos (and if you know what these are, you’re probably a little bit excited at not being charged extra for them) as part of the standard price tier. Ovum believes that Disney’s pricing is low enough to co-exist comfortably with Netflix (or another generalist streamer like Amazon), while also offering significant differentiators in price and functionality that constitute about the most credible competition Netflix has had yet. Disney+ pricing also looks tempting to what is likely to be a growing segment in maturing, saturated OTT markets: those who are bored of Netflix and Amazon and are looking for something new, even if only for a few months.

For more information on Ovum research, contact [email protected].