After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Eastern promise

Digital TV Europe’s CEE 2011 provides its annual statistical overview of the region’s key markets and, over the next few pages, predicts how the pay TV industry is likely to evolve.

The pay TV sector in central and eastern Europe came through the global economic crisis relatively unscathed. New services have continued to launch, and consolidation is yet to materialise in most markets. This means competition remains rife.

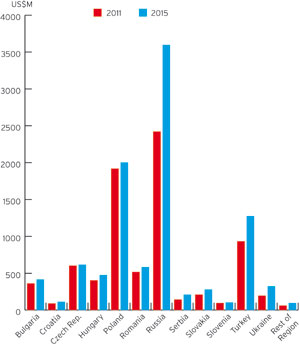

Russia and Poland continue to dominate the region’s pay TV market, between them accounting for almost half of revenues. Satellite services have performed particularly well and are expected to overtake cable as the leading platform in 2012.

Digital TV was slow to take off and in many markets that still rings true. But others are starting to see real progress – notably Russia, Hungary, the Czech Republic and Poland – and, according to Informa Telecoms and Media, digital TV is forecast to grow fairly rapidly in the region. Having ended 2009 with 44 million digital TV homes, the region is expected to close 2015 with 125 million digital households – a near three-fold increase.

Czech Republic

The Czech Republic remains one of eastern Europe’s most dynamic TV markets. The recession had a major impact on the country, with GDP contracting 4.1% in 2009. More than a third of the country’s 4.4 million TV households take DTT services, another third take DTH services (although only 15% are paying customers), a quarter take cable, leaving 5% of TV households with IPTV services.

According to the Czech Association of Electronic Communications, cable subscriptions reached 1.05 million by end-2009, up 80,000 year-on-year, and 90% of households had access to digital cable services. However, cable is losing market share.

UPC accounts for more than half of Czech cable subscribers. Its operations are located in over 90 cities and towns and the operator ended 2010 with 524,300 cable subs, down from 532,000 a year earlier. However, digital penetration increased to 78.6% by end-2010, with 411,800 subscribers.

UPC also operates its DTH platform UPC Direct in Czech Republic, but the service has lost subscribers recently. It ended March with a total of 81,000 satellite customers after losing 4,500 during the first quarter of 2011, putting it in fourth place in terms of DTH subscriber numbers.

Telefonica O2, which also operates an IPTV service, estimated nearly 1.5 million DTH homes by end-2009, although the telco doesn’t break down its TV subscriber numbers. However, nearly a million of these homes received free DTH services. In September 2006, Romania-based Digi TV won a DTH licence from the Czech Radio and TV Council and a third licence went to CS Link in late 2006. SkyLink became the market’s fourth DTH provider when operator Towercom teamed with card vendor TradeTec to expand the previously Slovak-only service into the Czech Republic in October 2008.

SkyLink’s pre-paid DTH service had around 800,000 active smartcards by end-2010, up 29% from 2009. However, not all are classed as pay TV subscribers. CS Link, backed by SPD Corporation (which holds the Czech Digital Group DTT multiplex licence) and GES Media Asset (which controls half of broadcaster Prima), ended 2010 with 539,000 active prepaid customers in the Czech Republic, up 29% on the previous year.

In terms of IPTV, incumbent Telefonica’s service launched in 2006 and ended 2010 with 129,000 subs, losing 9,000 subs over the previous 12 months. Slow subscriber growth has been attributed to greater competition from DTT, which O2 believes presents a significant enough improvement on analogue terrestrial TV to deter Czechs from paying for extra channels. Total DTT penetration was 41.1% at mid-2010. About 1.6 million homes – over a third of TV households – were primary DTT homes in 2010.

Hungary

Hungary has one of the most competitive TV markets in eastern Europe. Over half of its 4.2 million TV households subscribe to cable, though these numbers are falling as homes are attracted either to low-cost DTH or triple-play bundles from IPTV operators.

Hungary had 1.48 million digital TV homes at the end of March, according to the latest figures released by the country’s media regulator, the NMHH, up from 1.2 million a year earlier.

According to the regulator, based on the coverage of the 12 largest TV distribution networks, about 3.8 million homes in the country take some form of subscription TV service, with the remaining 800,000 homes taking either analogue free-to-air or digital-terrestrial TV. Cable and IPTV combined has a market share of 21.8%. DTH accounts for a 33%.

Taking all services into account, UPC is the leading platform with a 28.9% share, followed by Romanian company RCS & RDS’s Digi platform with 26.6% and telco Magyar Telekom with 24.8%.

In terms of cable, there are more than two million subscribers split between 400 operators. UPC is the market leader, with 896,00 subscribers, of which 265,000 take digital services. The second largest operator is Magyar Telekom but it is facing falling subscriber numbers. It ended March with 402,911 cable TV customers, almost 60,000 fewer than a year earlier. Both UPC and Magyar Telekom also offer DTH platforms. The former ended March with 198,000 after adding 8,400 in the previous three months, while Magyar Telekom has also grown its DTH base to 261,000, up from 196,000 a year earlier. RCS & RDS’s DigiTV DTH platform has the most subscribers but it is losing them. It ended 2010 with 357,600, down 13.4% at the end of 2009.

Magyar Telekom also offers an IPTV service, Hungary’s largest, with 146,135 subscribers. It almost doubled its customer base in the 12 months to the end of March.

Poland

The Polish pay TV market is dominated by DTH operators, which between them have attracted eight million subscribers, compared with 4.7 million cable households.

By the end of 2010, there were over six million paying DTH subscribers taking services from one of the four main operators – Cyfrowy Polsat, Cyfra Plus, ‘n’ and TP/Orange. Of those, Cyfrowy Polsat is the country’s largest operator, with 3.43 million subs at the end of 2010.

Cyfra Plus, part of the Canal Plus Group, is Poland’s second-largest DTH operator, with 1.55 million subs at the end of 2010. It offers over 70 Polish channels as well as the Cyfra Plus premium service. It has benefited from holding the rights to Polish soccer matches since the 2006/7 season, but the renewal of the rights has been problematic, with rival bids coming from broadcaster TVN. In 2010, sister company Canal Plus secured the English Premier League rights for three seasons.

TVN Group-owned DTH platform ‘n’ had 805,000 active post paid subs and 332,000 prepaid subs at the end of the year and the company reached its goal of generating ARPU of PLN60 (915) by the end of December 2010. The operator offers the most extensive HD line-up of all the country’s pay TV operators, with a total of 27 channels.

Telco TP/Orange had 464,00 DTH subscribers at the end of March, after adding 33,000 since the end of the year.

Cable operators have been slow to upgrade networks, due partly to fragmentation and also a result of the high costs involved. UPC Polska is the only operator with over one million subscribers. The Liberty Global-owned operator, which has upgraded most of its network, ended March with a total of 1.1 million subs. It is followed by Vectra, which has 773,000 subscribers.

Multimedia Polska is Poland’s third-largest cable operator. It ended 2010 with 699,114 TV subs, and a total of 1,325,870 RGUs. In March, the operator became the first cabler in Poland to launch an OTT service offering TV channels and VOD. Marketed as mmTV.pl, it offers access to over 1,000 movies and TV channels. Fourth-placed Aster was acquired by Liberty Global in December 2010 for PLN2.4 billion (e600 million), including net debt. The acquisition will increase UPC’s cable market share to around 30%. Aster operates in Warsaw, Krakow and Zielona Gora and by end-2010, had 368,000 subscribers, down from 380,000 a year earlier.

Competition from IPTV services has been fairly low and the country was home to just 186,000 IPTV homes at the end of 2010, despite 5.93 million people taking a broadband subscription.

Romania

The Romanian pay TV market is marked by the fact that the main operators offer a mix of cable and satellite, with some also offering IPTV services. With cable, DTH and IPTV operations, RCS & RDS is the market leader. UPC also has cable and DTH assets (trading as Focus Sat) as does Akta (formerly known as Digital Cable System and Max TV). Already well established as a DTH operator, OTE-backed Romtelecom’s Dolce TV launched its IPTV service in December 2009. The operator increased its TV subscriber base in 2010, surpassing the one million mark in the course of the year. It ended December with 1,053,627 TV customers, up 15% from 911,040 at the end of 2009.

According to Romanian regulator ANCOM, the country had 5.73 million pay TV subscribers at mid-2010, down 1.7% from end-2009. This total accounted for 70% of TV households. Cable remains the most popular pay TV option, although the platform lost 1.2% of subscribers in the first half of 2010. The number of DTH subscribers also declined, by 3% and while IPTV experienced growth, it only represents 0.2% of the market.

ANCOM reported 3.37 million cable subs at mid-2010, down from 3.41 million at end-2009. There were only 350,000 digital cable subs at mid-2010 although this figure was up 10.5% in six months. DTH appears to be reaching market saturation, despite the low-cost promotions. Boom TV, one of five DTH operators, felt the strain from market competition, filing for insolvency in May 2010. The company continued to operate, albeit whilst haemorrhaging subscribers, and was recently acquired by telco and DTH operator Romtelecom. There were 2.4 million DTH subs by September 2010, of which 82% belonged to Romtelecom’s Dolce (one million) or RCS & RDS-owned Digi TV (970,000).

UPC Romania ended March with 1.139 million “customer relationships”, including 304,000 digital cable customers and 235,000 DTH subscribers. In February it was reported that RCS & RDS was close to acquiring UPC Romania from Liberty Global for around US$300 million (2205 million). Should the deal go ahead, RCS & RDS would be by far the leading operator in the market, providing TV services to around four million homes.

Russia

Russia was home to an estimated 13.4 million cable subs at the end of September 2010 and cable association AKTR

optimistically forecasts 25 million cable subs by 2015. However, 70% of cable subscribers only pay to receive the ‘social package’ of terrestrial channels.

Russia has 600 cable operators and 60 MMDS platforms, but only 10% have more than 20,000 subscribers, and six companies control around 60% of subs. Moscow accounts for almost one-third of the country’s cable TV revenues.

Service provider Sistema Mass Media is consolidating its telecoms and TV assets under the MTS brand. Sistema owns 53% of MTS, the country’s leading mobile operator. Many of Sistema’s TV interests were previously placed under subsidiary Comstar-UTS, trading as Stream TV. By September 2010, Comstar had over 1.9 million pay TV subs.

Rostelecom has been buying out minority shareholders in Svyazinvest’s seven regional telcos to create a single unit. Svyazinvest is targeting a 17% share of pay TV revenues by 2015. One of the subsidiaries, Central Telegraph, is in the process of building its Universal Multi Service Network in Moscow to cover 1.5 million apartments. With a 2,000km fibre-optic network already operational, the company had 224,000 broadband subscribers and 40,000 IPTV subs under the Qwerty TV brand at September 2010. Also owned by Svyazinvest, North-West Telecom launched an IPTV service in April 2008 under the Avangard TV brand, which offers a network DVR system with up to 72 hours storage. Avangard TV had 25,000 IPTV subs by September 2010. Southern Telecommunications, another Svyazinvest asset, launched an IPTV service in late 2005 under the brand name DiSeL-TV. Informa estimates that it ended September 2010 with 691,400 broadband and 39,500 IPTV subs.

In terms of DTH, take-up has soared but most homes receive free or near-free services. Seven services are available: NTV-Plus, Tricolor TV, Russian TV Time (RTVT), Raduga, Platforma HD and two from Orion Express (Viva TV and Continent TV). An eighth operation, a pre-pay service known as Telekarta, launched in September 2010.

Tricolor TV is the most successful DTH service in terms of customer numbers with an estimated 7.5 million. However, it has gained scale by offering a free subscription for the first year. NTV-Plus ended September 2010 with 750,000 subscribers and despite adding channels and a greater range of services, it has not met the desired subscription growth. Viva TV, the DTH service provided by Orion Express, a subsidiary of Moscow-based Telecom Express, had 155,000 subscribers at September 2010.

Ukraine

Ukraine has 18 million TV households, with around 3.8 million pay TV homes.

State statistics committee Ukrstat said there were 3.46 million cable TV subscribers in Ukraine at the start of the year. The cable sector is fragmented, with more than half the subs served by operators with fewer than 10,000 subscribers and it is estimated that are up to 700 operators. Volia, jointly owned by private equity firms Sigmableyzer and Providence Equity Partners, dominates the cable sector. Including its subsidiaries, the operator had about 1.4 million subscribers at the start of 2010.

In terms of DTH, there are more than two million homes with satellite TV. However, the vast majority of these households receive only free-to-air channels. Launched in April 2008, Vision TV (Viasat) is a joint venture between Sweden’s Modern Times Group and local set-top box manufacturer Strong Media Group. MTG reported that Viasat’s premium DTH services in the Baltics and the Ukraine had a combined subscriber base of 245,000 by end-2010. Vision TV had 110,000 subscribers at end of the third quarter of 2010.