After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

DTVE Data Weekly: Telcos’ enthusiasm for cloud gaming appears to be cooling, but it’s far from game over

Telcos are the leading force in the cloud gaming partnerships space, according to Omdia’s research, as they look to expand their bundled offerings beyond music and video with varying degrees of success.

As the growth of fixed broadband and mobile data slows down in saturated markets, telcos are exploring new opportunities beyond their core business. Gaming has become a clear area of focus; consumer spend on games now outweighs that on OTT video, digital music, and smart home services put together. Fortunately for telcos, gaming is no longer confined to consoles and PCs; spend on mobile games is bigger than console and PC combined. Always-on connectivity is also now crucial for the gaming experience, regardless of the platform – be that for authenticating purchases, downloading updates, accessing key game features, or playing online.

Video games is, however, a notoriously difficult area to break into, especially for non-gaming companies – even Amazon and Google have failed to make as big of an impact as they hoped. Encouragingly, given the gaming industry’s diverse and continuously growing nature, it offers niches where the likes of telcos can play a role. Enter  cloud gaming. Thanks to the tech giants’ entry or re-entry into cloud gaming in 2019, industry excitement around streaming games quickly reached fever pitch. Its high speed and low-latency network requirements proved tantalizing for telcos, who moved quickly to partner with cloud gaming providers to showcase their network capabilities.

cloud gaming. Thanks to the tech giants’ entry or re-entry into cloud gaming in 2019, industry excitement around streaming games quickly reached fever pitch. Its high speed and low-latency network requirements proved tantalizing for telcos, who moved quickly to partner with cloud gaming providers to showcase their network capabilities.

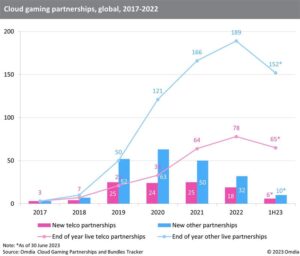

However, it soon became apparent that streaming would not disrupt gaming as quickly or to the same extent as it did music and online video. The shuttering of several services due to an apathetic response from gamers further dampened enthusiasm. According to Omdia’s Cloud Gaming Partnerships and Bundles Tracker, the number of live telco-led partnerships decreased from its peak of 78 at the end of 2022 to 65 in mid-2023 (see chart on the left). The number of new partnerships is also on a downwards trend.

Despite the reduction in the total number of partnerships, it doesn’t necessarily mean that cloud gaming is doomed. There are now fewer short-lived marketing alliances, but an increasing number of long-term commercial relationships between telcos and cloud gaming providers.

The cloud gaming market is seeing a lot of M&A, but it remains diverse

According to Omdia surveys, in 2023, 48% of consumers in US, UK, and Germany had heard of cloud gaming services (up from just 14% in 2020). However, 65% of those who were aware of these services had no intention to subscribe. Nine per cent of all respondents have now at least tried cloud gaming – up on four per cent in 2020. In relation to the total games market, cloud gaming is still nascent and primarily driven by download-led services which offer cloud gaming as a value-add feature (e.g., for trying games instantly before downloading them to their consoles), as seen with Xbox Game Pass Ultimate and PlayStation Plus Premium.

Cloud-only services have struggled to find a big enough audience and achieve profitability. High operating and content acquisition costs led to Google Stadia, Deutsche Telekom Magenta Gaming, and Hatch shutting down in the past two years. Several smaller/specialized cloud gaming service providers stopped operating in this space, either as a result of being acquired or pivoting their business away from cloud gaming.

Cloud-only services have struggled to find a big enough audience and achieve profitability. High operating and content acquisition costs led to Google Stadia, Deutsche Telekom Magenta Gaming, and Hatch shutting down in the past two years. Several smaller/specialized cloud gaming service providers stopped operating in this space, either as a result of being acquired or pivoting their business away from cloud gaming.

Nevertheless, cloud gaming remains diverse, with both tech giants and smaller companies continuing to play an important role (see chart above). In the near term, challenges around network speeds and latency will limit the appeal of streaming games, but overall, cloud gaming is here to stay. Omdia believes that cloud gaming and subscriptions will become an increasingly important part of the games market; where it will mostly complement, rather than cannibalize, the growth of the entire sector.

Telcos were quick to embrace cloud gaming, but it’s clear that not all have found success

Telcos have been involved in over 100 cloud gaming-related partnerships since 2017, 61% of which remain active. There are several key motivating factors for telcos, including 5G network rollouts, the search for an attractive consumer use case, and a desire to differentiate and reduce churn. They hoped that cloud gaming subscription services could help them attract the high-spending dedicated gamer demographic, as well as family households.

Telcos have been involved in over 100 cloud gaming-related partnerships since 2017, 61% of which remain active. There are several key motivating factors for telcos, including 5G network rollouts, the search for an attractive consumer use case, and a desire to differentiate and reduce churn. They hoped that cloud gaming subscription services could help them attract the high-spending dedicated gamer demographic, as well as family households.

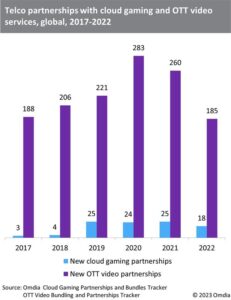

Unsurprisingly, the number of cloud gaming partnerships pales in comparison with OTT video service partnerships (see the chart on the left). Interestingly, the OTT video space has also experienced a decline in the number of new partnerships since 2020. However, this is explained by the maturity of OTT video partnerships – the same can’t be said about the nascent area of cloud gaming.

Long-running cloud gaming partnerships suggest it has been a worthwhile endeavor for some telcos

Sixteen cloud gaming-telco partnerships have been live for longer than three years, suggesting that these telcos have seen value and benefits in continuing their collaboration. Despite the presumed success of these partnerships, telcos have been reluctant to share specific milestones such as subscriber numbers or revenues related to their cloud gaming activities. This could suggest in some cases that the direct financial impact of cloud gaming on telcos may not be significant or remarkable.

Conversations within the industry indicate that telcos have found success indirectly through cloud gaming, which is evident in two ways: Firstly, cloud gaming requires significant data consumption, which can drive up data usage among subscribers. Telcos take advantage of this by upselling higher-tier data plans, or services such as fiber or 5G connectivity. Secondly, cloud gaming provides an opportunity for telcos to showcase the capabilities of their set-top boxes, encouraging customers to upgrade to more advanced models and enjoy enhanced gaming experiences.

Over the past two and a half years, more than half of 5G tariffs launched globally have come bundled with third-party or telco own-brand subscription-based digital services, or both – highlighting that the desire to bundle services remains very strong. As cloud gaming is integrated in popular entertainment services in the future (e.g., Netflix), the ability to stream games will become so ubiquitous that millions will be unknowingly playing games in the cloud. This anticipated development will present both challenges and opportunities for telcos, requiring them to adapt and capitalize on the changing landscape.

This article is drawn from Omdia’s report Telco Opportunities in Gaming: Assessment of Cloud Gaming Partnerships.

George Jijiashvili is senior principal analyst, games at Omdia.