After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

DTVE Data Weekly: Fighting for the SVOD crown

When considering a consumer’s ever-growing subscription video service portfolio, where a service stands in the hierarchy is increasingly important. Omdia Consumer Research has investigated the service stacking compositions of major online video markets worldwide for more than five years, tracking the emergence of new direct-to-consumer services and the growth of the forerunners in this sector.

Source: Omdia

When considering the primary video service for a given consumer or household, names such as Netflix and Amazon Prime Video may immediately come to mind, given their longevity in the online video market and subsequent prevalence globally. Equally, local pay-TV providers offering traditional TV consumption alongside increasingly detailed and complex bundles remain prevalent platforms worldwide.

SVODs vs Pay TV and Social Media

Research derived from the Omdia Consumer Research survey shows that consumers tend to select a paid subscription video service, be it online or pay TV (the latter overwhelmingly so, if owned), as their first choice when looking for something to watch. This is typically consistent across all markets and all demographic groups. Even those aged 18–24, the demographic with the most noticeable measured skew to social media services such as TikTok, YouTube, and Twitch, favour their paid subscription services, with almost 60% of respondents in this age cohort citing paid services as their first choice when looking for something to watch.

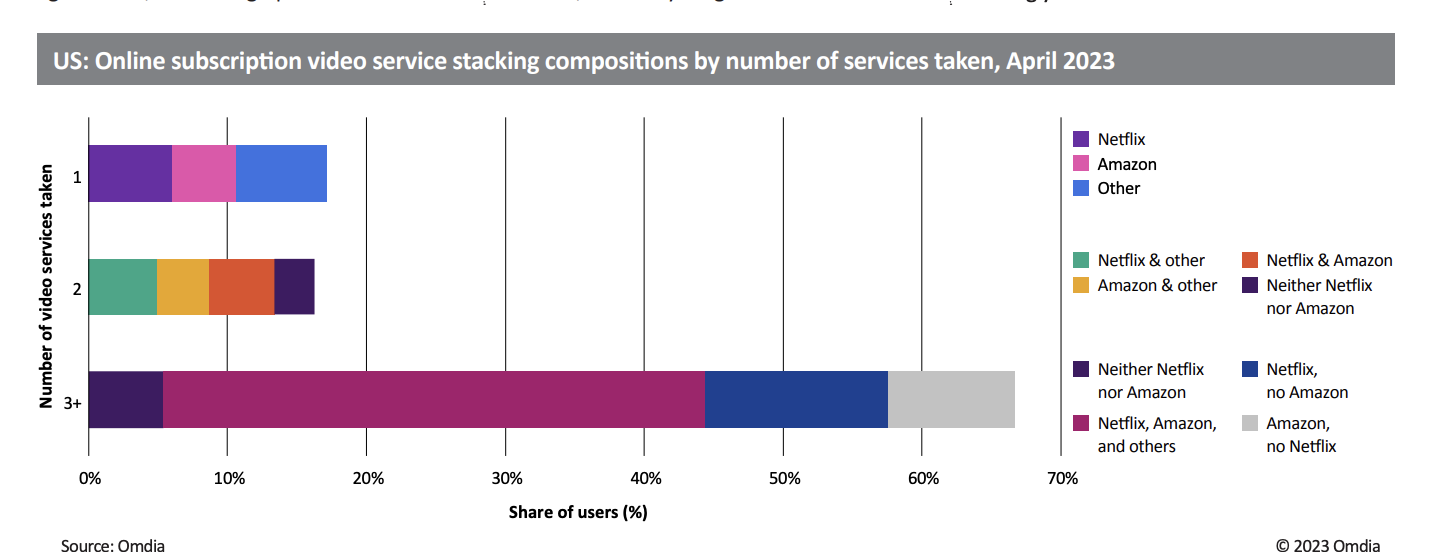

In the online subscription video service space, where increasing service stacking is an ongoing trend in markets around the world, the battle to be the primary video service in a portfolio of multiple paid options is increasingly important as consumers consider whether their services provide value for money. Considering the aforementioned high-profile services in a given online video service portfolio, Omdia Consumer Research suggests that an overwhelming majority of consumers take either Netflix or Amazon Prime Video as part of their video portfolio. In the US, fewer than 15% of online subscription video users took neither as one of their online video services.

There is also a noticeable negative correlation between the number of online subscription video services taken and the share of respondents taking either Netflix or Amazon, with a rate of 62% for those with just one service, rising to nearly 92% for those with three or more services.

Across all Omdia Consumer Research sampled markets, respondents taking both Netflix and Amazon Prime Video had high levels of engagement for both services, with daily usage rates of 44% and 31%, respectively. More than one-third of users cited either service as their first choice. However, competition with other international and domestic video services is increasing, and these two services will find their titles increasingly challenged over the coming years.

Max Signorelli is Omdia’s principal analyst, Media & Entertainment