After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

DTVE Data Weekly: Online video in Western Europe

Source: Omdia

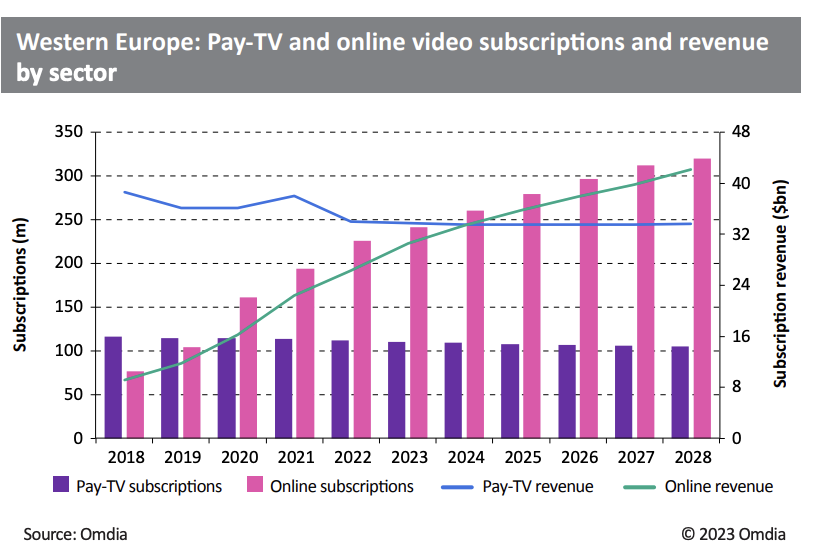

Looking at the latest full-year data for 2022, the pay-TV and online market enjoyed another successive year of growth in Western Europe, with total subscriptions reaching 336.3 million. Online video, once again, drove this uptake, adding 30.6m new customers in 2022—an increase of 15.8% over 2021. By contrast, pay TV continued its decline, dropping by 1.6% in the year after losing 1.8m customers across the region. As of late 2023, Omdia’s ongoing tracking of the market suggests that the full-year trend for 2023 will be similar.

At the end of 2022, online video subscriptions comprised 67% of the combined TV and video market, at 224.2m compared to pay TV’s 112m subscriptions. However, pay TV continues to generate a greater share of revenue than online video: in 2022, total pay-TV revenue reached $35.7bn (down by 7.1% YoY), holding a 58.1% share of all revenue generated from TV and video. If current trends persist, streaming revenue is set to at least match pay-TV revenue by 2025.

Netflix, the largest streaming service in Europe, is by far the region’s most popular TV and video service, with 65m paid subscriptions by the end of 2022 and an SVOD market share of 29% based on subscriptions. In 2022, Netflix’s total regional revenue grew to $8.7bn, increasing 1% from its 2021 revenue ($8.6bn). For the pay-TV market, Vodafone is the clear leader, with 14.8m customers, 86% of whom are linked to its German pay-TV service. Sky as a combined unit, however, generates the most revenue—$10.6bn—due to its extensive presence in the region (UK, Germany, Italy, Austria, and Ireland).

OTT highlights and major developments

A major theme that marked out 2022 as important was Netflix’s decline in subscriptions in the first half of the year and the subsequent introduction of an ad-tier option to its service to drive subscriptions—and, most importantly—revenue up again. The company has only launched this new ad-tier service in five select European markets (the UK, France, Germany, Italy, and Spain) in November 2022. In August 2023, Netflix’s OTT rival Disney announced it would also introduce an expansion of its ad-supported tier, which launched in the US in December 2022. From November 2023, the ad-supported tier was rolled out in the five Western European Netflix markets and four additional markets.

The loss of subscribers from Netflix triggered an inevitable reassessment of streaming’s long-term potential from the industry at large, leading many companies to close their services in 2023 while shifting their focus from chasing subscriber growth to achieving profitability. Lionsgate+ was a notable example, as the streamer exited most of its European markets, focusing on core English-language markets. French broadcaster-backed Salto also closed its service after just over two years in the market, having amassed around 800,000 subscribers in that time.

In 2022, the expansion of new direct-to-consumer streaming services and the launch of rebranded services continued. HBO Max launched in the Netherlands and Portugal in March 2022, while Discovery+ launched in Germany and Austria in June 2022. Paramount+ launched across multiple European markets, including the UK, Germany, and France, while Paramount Global and Sky’s joint venture streaming brand SkyShowtime replaced Paramount+ in select markets, including the Nordic countries.

Unlike 2021, DAZN’s customer base in western Europe fell for the first time 2022, losing 102,000 customers, with its key markets Italy (down by 1m) and Germany (down by 935,000) the prime instigators of this decline. The main cause of this was customers canceling their contracts once Serie A and the Bundesliga had ended in May 2022. However, other factors linked to this event also spurred further cancelations, including the huge price increase from DAZN at the start of the season in 3Q21, which led many customers with monthly contracts to cancel once the season had finished.

The company did, however, see a huge surge in new customers in Spain over the year, adding 1.6m new subscribers to reach 3m customers by year-end, an increase driven primarily by the launch of its new La Liga package at the start of the season in August 2022 (DAZN gained half the rights to La Liga in December 2021). To broaden the reach of its LaLiga coverage, the company also sublicensed its matches to Movistar and agreed to a distribution deal with Orange.

Source: Omdia

Pay TV: Country highlights

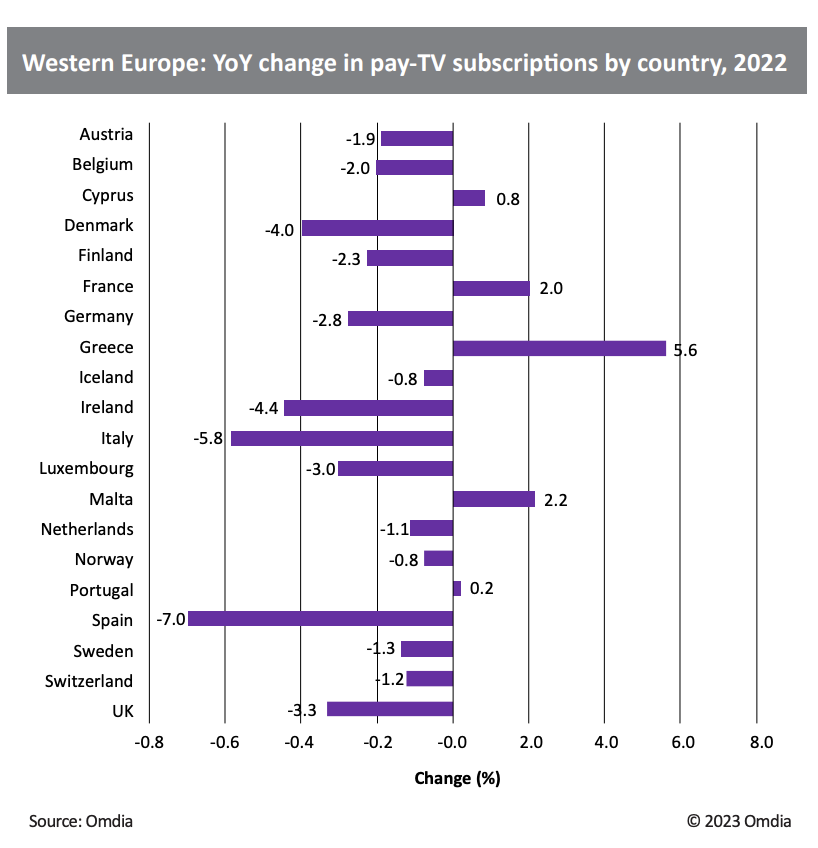

Most of the key pay-TV markets are now in decline in Western Europe or, in the case of France, are experiencing slower growth than the previous year. However, compared with other regions, the decline in pay-TV subscriptions is relatively flat and is not set to worsen substantially over the next six years. France was the only major market to grow in 2022, with a 2% (+520) increase from 2021. Growth across all its main pay-TV operators and platforms accounts for this, with operators such as Canal+ (+293,000), Free Telecom (+88,000), and Orange (+47,000) generating significant uptake. Germany remains the largest pay-TV base in the region, with 27m customers in 2022, accounting for 24.1% of the region’s total. The country also leads in pay-TV revenue, generating $7.2bn in 2022.

Like in the year prior, Italy and Spain experienced the most significant declines in their customer bases in 2022, with DAZN’s acquisition of the key soccer leagues from the countries’ respective top pay-TV operators Sky Italia (prime rights holders to Serie A) and Telefónica (partial rights holders to La Liga) playing a significant role in customer churn. On top of this, continual growth from incumbent OTT players and consumer moves toward social media platforms have driven many customers away from pay TV.

Pay TV: Platform highlights

IPTV was the only platform to register growth in 2022, increasing by 2.6% (+1.1m customers) to 44.4m customers, putting it ahead of cable TV by more than 3.5m. Markets including France (+674,000), Italy (+501,000), Germany (+125,000), Portugal (+66,000), Sweden (+72,000), and Greece (+63,000) primarily accounted for this growth.

In total, 15 of the 20 countries featured saw IPTV uptake in 2022. However, IPTV customers in the UK (-186,000) and Spain (-201,000) notably declined during the year, with BT, TalkTalk, and Telefónica driving this. By 2023, Omdia anticipates IPTV’s growth will fall to just 0.2% in 2023 before declining in 2024. In terms of growth rate, DTT fell by the highest margin in 2022, dropping by 26.7%. The closure of Sky Italia’s DTT played a substantive role in this, with the service losing 524,000 customers since 2021. German DTT service Freenet also experienced a considerable decline, losing 111,000 customers over the year. However, in terms of overall subscriptions, cable TV lost the most customers, outpacing satellite with a loss of 1.3m customers.

Rob Moyser, is Omdia’s senior analyst, TV & Online Video