After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

DTVE Data Weekly: Netflix in sub-Saharan Africa

Source: Omdia

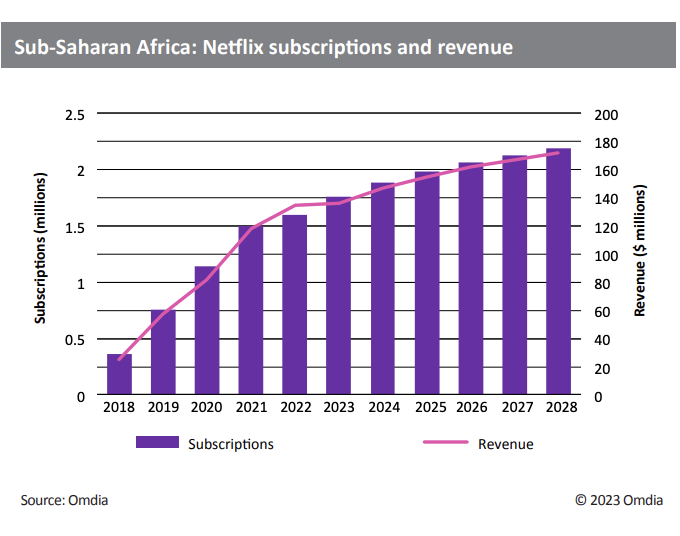

Netflix subscription numbers in sub-Saharan Africa rose by 6.8% between 2021 and 2022, reaching almost 1.6m by the end of the year. Subscription revenue exceeded $135m in 2022, an increase of 13.7% from 2021. However, increasing competition saw the company’s share of total OTT video subscriptions fall from 41.8% to 35.6% during the same period. Netflix has set its sights on the fastgrowing OTT opportunity in the region, having invested over $175m in sub-Saharan Africa since 2016, creating 12,000 jobs in South Africa, Nigeria, and Kenya alone.

Subscription boost

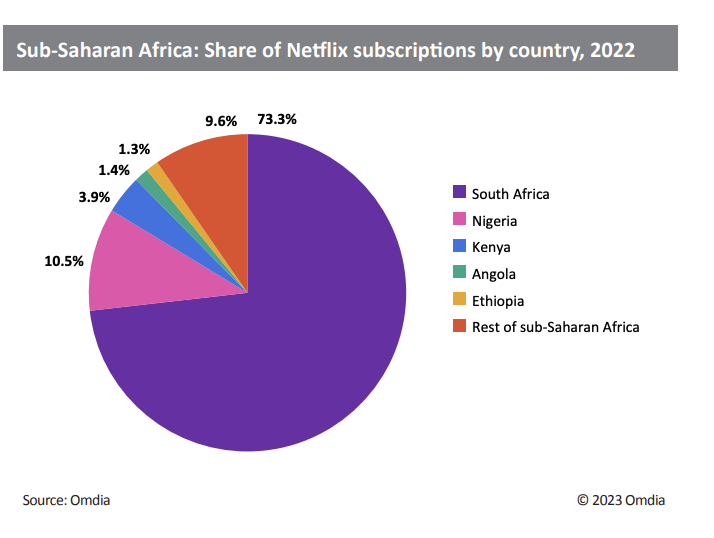

Netflix has faced mounting pressure from shareholders due to stagnating subscriber growth in its more mature markets. Still, it has seen rapid growth in Africa and is second only to Showmax in subscriptions in the sub-Sahara region. Following its launch in sub-Saharan Africa in 2016, Netflix subscriptions had risen to almost 1.6m by the end of 2022, and Omdia expects subscriptions to increase at a CAGR of 5.5% to 2.2m by 2028. This is below the overall market, which we forecast to increase at a CAGR of 10.4%, as new and smaller operators will likely capture a bigger portion of Netflix’s market share of future subscriptions. South Africa, Nigeria, and Kenya are key markets for Netflix in the region, representing over 87% of the service’s regional subscriber base in 2022.

South Africa is the most developed economy in sub-Saharan Africa and has the most mature online video market. It is also the most important market for Netflix in the region, accounting for 73.3% of its subscriptions and 69.5% of revenue in 2022. Netflix offers a mobile-only tier across several African markets and launched a completely free tier in Kenya in September 2021 due to payment facilitation obstacles.

Many pay-TV operators in the region, such as MultiChoice and StarTimes, have been forced to raise prices due to spiraling inflation, but Netflix has bucked the trend by implementing a slew of price cuts across several markets in Africa in 1Q23, as competition from established players and newer OTT platforms heats up in the region. Omdia forecasts Netflix subscription revenue to exceed $172m by 2028.

One of the major roadblocks to OTT video services finding success in sub-Saharan Africa is payment methods. In many regions, credit and debit card penetration is very low, making payments for online services significantly more complicated for those without cards. To address this, Netflix has been partnering with telcos and traditional pay-TV operators in the region, which essentially perform the task of last-mile content delivery and carrier billing. Telcos also offer other benefits such as mobile data cost subsidization to customers.

For example, Netflix formed a partnership with Canal+ Mauritius in 2020 and is now integrated into Canal+ 4K Android TV decoders. Netflix is available as a paid add-on option to customers taking the operator’s Cine & Series packages. In November 2020, regional giant MultiChoice integrated Netflix into its DStv Explora Ultra STB platform, with a dedicated Netflix remote button and optional carrier billing support. In October 2022, Netflix became available via DStv Streama, MultiChoice Group’s new connected TV (CTV) streaming device, which features a dedicated Netflix button on the remote.

Netflix’s partnership with state-controlled Telkom SA was discontinued in October 2021, with the South African telco declining to provide any further details on why the deal ended.

In the wake of increasing competition and strains on consumer spending, Netflix slashed subscription prices across several markets in February 2023 as it moved to incentivize new customers to sign up and maintain current subscribers. Prices in Kenya were cut by 37% on average, with basic tier pricing dropping by 57%, making Kenya the lowest-cost market in the sub-Sahara region. Netflix launched an Android mobile-only free tier in Kenya with reduced content in 2021 to get around the weak payment infrastructure in the country, giving subscribers access to a quarter of its catalog of movies and television shows. Omdia views the subsequent 2023 price reduction as a strategy to encourage existing free-tier subscribers to convert into paid ones.

The price cuts were significant—as much as 60% in some African markets where subscriptions are priced in US dollars—as Netflix prioritizes subscriber growth over profitability. However, prices in the key markets of Nigeria and South Africa, where pricing is in local currency, were not reduced. Mobile and standard pricing in Nigeria is still the same as Showmax. With competition from established players and newer OTT platforms heating up in the region, Netflix decided the price-cut strategy was necessary to ensure it generated the scale needed to succeed.

Local content investment

Netflix has invested over $175m in local content production and licensing in sub-Saharan Africa since launching operations there in 2016. It is also implementing plans to expand its operations in Africa in 2023, building on the recent success of local shows that the OTT service has produced on the continent, such as the South African series Blood and Water. With a growing demand for local content, Netflix’s move to expand its operations in Africa represents a significant investment in the continent’s creative economy and an opportunity to showcase African stories to a global audience. Local content in Africa is king and provides additional benefits to online video operators, such as lower production costs and reduced foreign exchange exposure when deals are structured in local currency. Netflix has formed a multi-project content partnership with South African filmmaker Mandlakayise Walter Dube, who directed Netflix’s first commissioned African film Silverton Siege in 2022.

Declining subscription share

Although Netflix’s subscription numbers in subSaharan Africa are rising, Omdia forecasts that the company’s share of total OTT subscriptions in the region will continue falling as competition from other OTT operators intensifies. From 2019 to 2021, Netflix enjoyed a market-leading share of OTT video subscriptions in sub-Saharan Africa. The service had just under 1.6m subscriptions recorded at the end of 2022. However, MultiChoice-owned Showmax overtook Netflix in 2022 and had amassed almost 1.8m subscriptions in the region by the end of the year.

Samuel Nkwam is Omdia’s Research Analyst, Media & Entertainment