After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

DTVE Data Weekly: Insights into the French pay TV and online video user

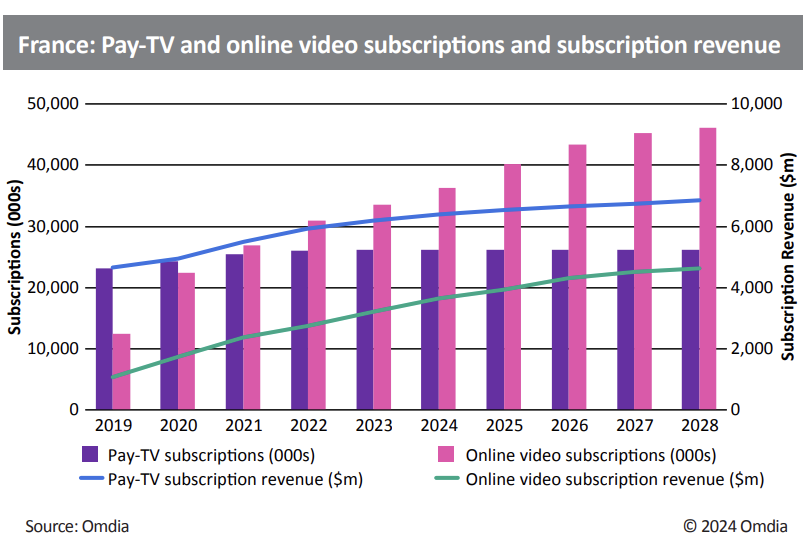

Omdia’s latest full-year data shows that the number of pay TV subscriptions in France surpassed 26m in 2022, achieving year-over-year growth of just 2.4%. Total subscriptions are set to remain around the 26m mark through the end of the forecast period in 2028. Total online video subscriptions are now firmly ahead of pay-TV subscriptions, growing by 15.4% from 31m in 2021 to 33.5m in 2022. This total will continue to increase in the coming years, surpassing 45m in 2027.

Subscription revenue for online video is also growing faster than that of pay TV, although online video sits behind pay TV in that regard. We forecast pay TV subscription revenue to surpass $6bn in 2023 and $6.8bn in 2028. Online video subscription revenue will hit $3.2bn in 2023 and just over $4.6bn in 2028.

IPTV remains the largest television platform in France, with 64% of TV households using it as their primary television platform in 2022. This is a slight increase on 2021’s penetration of 62%. Unsurprisingly, IPTV is prominent across all of France’s regions. French regulator ARCOM notes that usage of IPTV in the Île-de-France (which includes Paris) region charts well above the national average. Primary TV household penetration rates for cable, satellite, and DTT platforms remained level or declined slightly from 2021. According to ARCOM, Normandy and Bretagne are the regions with the highest DTT usage, while Nouvelle-Aquitaine is the region with the highest satellite usage. Orange is the leading pay TV operator in France, with its IPTV and satellite platform customers accounting for 31% of the country’s pay TV subscriptions.

IPTV remains the largest television platform in France, with 64% of TV households using it as their primary television platform in 2022. This is a slight increase on 2021’s penetration of 62%. Unsurprisingly, IPTV is prominent across all of France’s regions. French regulator ARCOM notes that usage of IPTV in the Île-de-France (which includes Paris) region charts well above the national average. Primary TV household penetration rates for cable, satellite, and DTT platforms remained level or declined slightly from 2021. According to ARCOM, Normandy and Bretagne are the regions with the highest DTT usage, while Nouvelle-Aquitaine is the region with the highest satellite usage. Orange is the leading pay TV operator in France, with its IPTV and satellite platform customers accounting for 31% of the country’s pay TV subscriptions.

Streamers

Netflix remains the largest service in France, accounting for nearly 34% of all online video subscriptions at the end of 2022. Amazon Prime Video and Disney+ also hold their places as the second- and third-largest operators by subscriptions, respectively. Collectively, these three global players account for just under 70% of all online video subscriptions in France. According to Omdia Consumer Research, gaining access to a range of content was the key driver in consumers’ choice to subscribe to Netflix, Amazon Prime Video, and Disney+. The lack of advertising on these services was the second key driver for subscribing to a service in the first place, which is notable given that these services are introducing advertising tiers and increasing the price of their non-advertising subscription tiers.

Since April 2020, the proportion of French online video households with just one online video service dropped from over 54% to just 40.4% in April 2023. In contrast, the proportion of OTT homes with more than four services increased from 9.2% in 2020 to 16% in 2023. Despite this recent shift toward ownership of a higher number of services, 84% of all OTT homes still take three or fewer online video services (and over 75% take two or fewer). This suggests that consumers are interested in taking up more services but are not taking on more purely because more services are available to them. Consumers are becoming more conscious of their spending on subscription services, which can drive increased churn.

Matthew Evenson is Omdia’s research analyst of media & entertainment