After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Channelling on-demand

Video-on-demand services are becoming ubiquitous, taking many forms across Europe. The business models for pay-TV operators are becoming clearer, but what about channel providers? Graham Pomphrey reports.

Much has been written about the growth potential for video-on-demand services. High-profile launches on various platforms, including PC, as well as the rise in popularity of catch-up viewing have led some to believe that the end is in sight for linear television. This might be wide of the mark, at least for the time being, but the popularity of on-demand services is certainly on the rise.

According to a survey in March 2009, conducted on behalf of the Association for Television On-Demand, a regulator of UK on-demand services, half of UK TV viewers had used a VOD service, with 30% doing so on a weekly basis.

Across Europe, pay-TV operators have launched services in various guises as VOD becomes a ‘must-have’ feature to stay ahead of, or to keep up with, rival platforms. Channel providers have taken note and realise the need to deliver content on demand – as much to keep platform operators happy as to market their own linear brands. How they can best exploit their assets in the on-demand space remains to be seen. For the time being, operators seem to be in the best position to deliver and promote VOD content to subscribers, but might channel providers – and other content owners – be persuaded to go direct to consumers?

Across Europe, pay-TV operators have launched services in various guises as VOD becomes a ‘must-have’ feature to stay ahead of, or to keep up with, rival platforms. Channel providers have taken note and realise the need to deliver content on demand – as much to keep platform operators happy as to market their own linear brands. How they can best exploit their assets in the on-demand space remains to be seen. For the time being, operators seem to be in the best position to deliver and promote VOD content to subscribers, but might channel providers – and other content owners – be persuaded to go direct to consumers?

“Some might like to think they’re big enough to do that,” says Tony Kelly, CEO of On Demand Group, (ODG), a company that manages VOD libraries for service providers, including Virgin Media. “But customers want a range of content from various channel operators. They don’t want to have to keep switching between services.”

[icitspot id=”9468″ template=”box-story”]

Hollywood studio and channel operator MGM has VOD relationships with major operators in nearly every European territory. The company’s main focus for VOD is to expand distribution through established service providers. However, Gary Marenzi, co-president of worldwide television, says a direct-to-consumer option should never be entirely ruled out. “Service providers continue to be a critical component to distributing programming. However, MGM is always evaluating opportunities to better distribute its product and direct to consumers is always an option,” he says.

According to AETN International’s senior director, international digital media, Fabienne Fourquet, the company could be prepared to deliver on-demand content directly to consumers in the right circumstances. “We are open to delivering direct on-demand services in countries where we do not have a branded linear presence,” she says. Although she asserts that where the company has a carriage deal, the service provider will always be the key element in providing services in a way that consumers understand. In most cases, consumers need to be educated both of the benefits on-demanding viewing offers and in some cases how to actually use such services. “To date, the service provider is offering pay-TV services to viewers and they play the largest role in providing a rich, quality offering, both linear and non-linear,” she says. “Service providers are also best placed to educate the audience about the content and services available on their TV and how to access this content.”

AETN International offers on-demand services via a number of platforms across Europe, including BSkyB, Virgin and BT Vision in the UK, Maxdome in Germany, Free and SFR in France, Ono in Spain and UPC in Poland. It offers VOD content across all of its brands, including History, Bio, Crime & Investigation Network, and Military History, as well as some HD content from the History HD channel.

Effective marketing

According to Fourquet, much of the success of its VOD services is down to effective marketing on its linear channels, but she also believes operators play a crucial promotional role: “One of the best ways for channel providers to raise awareness of new services is to cross-promote non-linear services on linear channels. We also work with pay-TV operators to jointly create promotional campaigns for new series, highlighting exclusive content available only on VOD, such as short-form clips, producer’s cuts and behind the scenes footage.” Fourquet also highlights the need for creativity when developing VOD service. “For example, channel providers can collaborate with the platforms to premiere some key series on-demand in order to drive viewers’ take-up of these services,” she says.

According to Fourquet, much of the success of its VOD services is down to effective marketing on its linear channels, but she also believes operators play a crucial promotional role: “One of the best ways for channel providers to raise awareness of new services is to cross-promote non-linear services on linear channels. We also work with pay-TV operators to jointly create promotional campaigns for new series, highlighting exclusive content available only on VOD, such as short-form clips, producer’s cuts and behind the scenes footage.” Fourquet also highlights the need for creativity when developing VOD service. “For example, channel providers can collaborate with the platforms to premiere some key series on-demand in order to drive viewers’ take-up of these services,” she says.

HBO Central Europe has an extensive VOD offering across the region, including in Poland, Hungary, the Czech Republic, Slovakia, Slovenia, Serbia, Croatia and Montenegro. In most countries this is via IPTV operators but it also has a DTH push-VOD service in Poland. An SVOD service is likely to launch in Romania this year and the company is currently testing its broadband on-demand service in Poland, which will launch commercially this year.

As to whether HBO Central Europe would consider launching its own VOD services, CEO Linda Jensen says this would depend on how the pay-TV market evolves over the coming years. “Like any business, premium pay-TV providers want continuing growth,” she says. “As long as platform operators can provide robust increases in subscriber numbers, along with good customer service, there will probably be no incentive for pay-TV providers to go elsewhere. If the growth were to slow substantially, the pay-TV providers may ask questions about how to tackle the customer service issue and go direct to the consumer.”

Jensen agrees with Fourquet that increasing consumer usage of VOD services will fall on both channel provider and operator to educate and persuade viewers to consume video this way. Another key driver is offering compelling content, and for many viewers timing is all-important, she says. Hollywood studios and TV producers are experimenting with shortening the infamous release window for some releases in the hope of attracting more viewers. “Increasing usage of pay-TV services is undeniably all about compelling content and the timing of getting it to the linear and on-demand services, along with the communication to the consumer,” says Jensen. “Fortunately, the studios are working on shortening the lag in the release dates to our region, which is helpful, and we are as aggressive as possible in getting the content on the on-demand services and communicating it.”

An example of what HBO Central Europe is aiming to deliver is HBO US’s new series The Pacific, which will premiere in the US on March 14. HBO Central Europe will air the same episode on its linear feeds the following day. The aired episode will immediately be available on its on-demand services. “This is a very exciting development for us and a very marketable opportunity for ourselves and our operators,” says Jensen.

Factual channel provider Discovery currently distributes VOD through a handful of partners in Europe via its Discovery Networks International arm. The company has seen encouraging signs from its on-demand offerings, according to Alden Mitchell, vice-president, strategy for international business.

He says Discovery is keen to keep its focus on linear channels but sees on-demand as complementary to that side of the business. To that end, the company is keen to partner with operators that already offer its linear channels when launching VOD services. “We partner with distributors because they find us a lot of value. They’ve built front ends and are experts in opening and maintaining billing relationships with consumers. They are great marketing partners for us. To bring all of that in house is not the direction we’re going.”

Kids on-demand

While it might take time to persuade traditional TV viewers to venture away from the security of scheduled programming, kids are likely to be more open to on-demand viewing as they grow up with the technology. Children’s channels have taken note and many have begun introducing services.

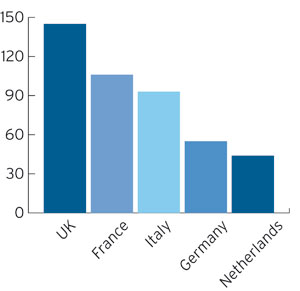

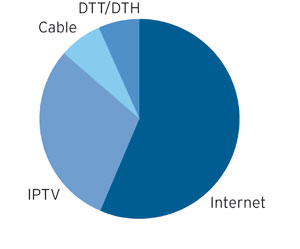

On-demand services by platform type* , *December 2008. Source: Video on demand and catch-up TV in Europe by the European Audiovisual Observatory and the Direction du Développement des Medias, published October 2009.

Kids broadcaster KidsCo has subscription-VOD services to support its linear channels with Ono in Spain, OTE in Greece and Planet 9 in Slovenia, as well as a further five VOD services in Asia. According to managing director Paul Robinson, kids feel particularly comfortable accessing on-demand content: “Children understand non-linear services and use VOD like a DVD player, with younger children in particular enjoying playing shows many times. Repeats are good for them. In general I think that children are more technology literate than adults and expect content to be made available to them in this way.”

Robinson believes the relationship a channel provider has with platforms will remain as important as ever, even as VOD services gain more momentum. “At KidsCo, we believe that we are in partnership with the platforms and we prefer to deliver content to them as part of that relationship,” he says, adding that the relationship customers have with platforms is also important. For this reason, he believes content owners would be ill advised to launch their own standalone service: “They don’t necessarily have the business-to-consumer expertise that is needed, and almost certainly they won’t maximise the value of their assets going down this route. Service providers act as trusted guides that helps consumers decide what content is worth watching and what is not. If you just dump a load of shows on a server the consumer could be overwhelmed.”

Turner Broadcasting Systems, a Time Warner company that operates a number of channel brands including Cartoon Network, TCM and CNN, began offering VOD content throughout Europe, the Middle East and Africa two years ago and has since signed around 30 deals across the region. “The market’s growing pretty quickly,” says senior vice-president of digital media Casey Harwood. “It was fairly obvious early on that we had to respond to the demand. Depending on where you sit, it’s either the future of TV or part of it. We think it’s part of the overall viewing mix, so people will want to watch on-demand and catch-up but they’ll also want to lean back and watch linear TV for a very long time.”

Most on-demand content is sourced from Turner’s kids brands, which include Cartoon Network. “When you consider how much viewing time kids have got, combined with their thirst for discovering new things, kids content really works,” says Harwood. “Kids are the early adopters and they have a high tolerance for repeat viewing. The young audience watching our on-demand content today will be completely accustomed to watching on-demand and catch-up television ten years from now.”

With Turner’s brands, particularly Cartoon Network and its associated programming, striking such a chord with viewers, would the broadcaster consider venturing out into the on-demand world alone, without the guiding hands of an operator? Unlikely, Harwood says: “We are a content company and it makes sense for us to work with specialists in delivering content to consumers. It’s better to partner that way than try to compete with [service providers]. It’s highly unlikely Turner would do that, beyond marketing our own websites.”

Business models

Virgin Media’s on-demand service epitomises the varied business models available to operators, with its mix of free, subscription and à la carte programming. While the operator does not reveal revenues for its VOD service, it’s certainly proving popular with subscribers – during the third quarter of 2009, it had an average of two million VOD users each month, representing 55% of the subscriber base. Average monthly views hit 66 million.

From an operator’s point of view, a VOD service can firstly act as a differentiator but can also be used to persuade people to upgrade to higher tier packages. Virgin Media’s TV Choice On Demand service is available for free only to customers taking the most expensive TV package, for example. “The fact that you get more customers into the higher tier means ARPU rises so it generates revenues that way. SVOD also brings in some revenues and as scale increases, advertising will become much more important,” says Kelly.

“To date, the service provider plays the largest role in providing a rich, quality offering, both linear and non-linear.”

Fabienne Fourquet, AETN International

From a consumer point of view, TV viewers are becoming more and more accustomed to watching TV anywhere on any device – be it a short form video clip on YouTube, a film on an iPhone or a documentary on a catch-up service. Operator-controlled VOD services offer a one-stop-shop for a range of quality content from various operators, delivered hopefully without any glitches unlike, perhaps, via the internet. So if VOD provides benefits for operators and consumers, where does the value lie for the channel providers?

“It’s really tough to know how the business model might evolve,” Discovery’s Mitchell concedes. Advances in on-demand advertising technology are still at the mercy of advertisers who will want to see much greater traction from VOD views before they are prepared to back such innovations with significant funds. “Until ad-support is realistic for VOD, it’s difficult to predict what the business model is,” says Mitchell. “Our content is premium and extremely valuable. We’re focussed on commanding value for the high quality content that we create. Arguably, including VOD in broader affiliate deals might increase the overall value of the deal but as the ad technology gets to the point of sophistication in terms of targeting and real-time delivery, as we hope it will, there could absolutely be revenues to be made.”For the time being, VOD will play a part in the overall marketing mix for many operators. “Broadly speaking, VOD is a platform that we’re very encouraged about,” says Mitchell. “We want our programmes to be available wherever our viewers want to see them, and that includes on-demand.” However, he says,the fact that the technology behind operator-controlled VOD platforms is still at the evolutionary phase means that the types of services on offer are limited by the likes of capacity, transmission and set-top boxes. Despite that, Mitchell says VOD is a “growing and interesting” platform that Discovery wants to be present in. “We’re a company that’s focussed on linear networks but we want to make VOD a great complimentary experience to that, rather than creating an explicit substitute.”

Harwood says Turner’s on-demand deals fall into three main categories. Firstly, traditional on-demand or catch-up services, which are closely tied to carriage deals. Secondly, deals with stand-alone services offering either electronic sell through or on-demand programming as part of an on-demand portal such as Germany’s Maxdome. The broadcaster also distributes short-form content to sites including YouTube. “These offer three distinct opportunities,” says Harwood. “Each offers its own business model although the lines do blur sometimes. Either way, we’re focussed on making sure we have the ability to do the deals, deliver the content and most importantly make sure there’s some correlation with the rest of our business.”

He says that whatever touch points the company has with consumers, whether via a VOD service, DVD or website – the aim is always to navigate them back to the linear channel. “It’s not just about direct dollars – that will emerge and grow – it’s about maintaining your core business by continuing to add value to it,” Harwood says, adding that VOD should not be considered on its own, but rather as part of a greater marketing tool for the whole brand, something that will hopefully lead new customers to its linear channels and keep existing viewers interested. “VOD and catch-up shouldn’t be viewed in isolation as a value-add. Interactive TV games are a huge opportunity for us, so is the ability to interact with mobile devices. Whatever way we reach out to our consumers, it’s important for us to showcase our content. The important thing is to manage that consumer back to a TV channel, hopefully monetising them on the way.”

Being able to offer content to operators’ on-demand services is not only important in terms of brand extension and marketing, it also serves to keep relations with operators congenial. “Offering on-demand content to our existing customers is vitally important because they need these kinds of services to move their platforms forward,” Harwood adds. “If you can’t supply that, you’ll get a haircut in terms of carriage rates. If you can, you’re supporting their business and hopefully increasing ARPU, which puts you in a favourable position.”

One thing in Turner’s favour is that it owns the rights to the vast majority of programming broadcast on its linear channels, making it much easier and less timely to strike deals with operators. Having strong brands also helps, according to Harwood. “We have strong media brands that act as umbrellas and ideally what we’d like to do in the on-demand space is to distribute our programming underneath our channel-led brands, as opposed to white labelling or licensing those programmes out to an on-demand service,” Harwood says. “People associate our programmes with our channel brands and there’s value in that continuity and cross promotion.”

Catch-up and online

On-demand viewing figures across Europe have been boosted by the rise of catch-up TV. In the UK, half of on-demand TV viewing takes place within 24 hours of the programme’s original broadcast on linear television, according to audience-measurement organisation Barb. Its survey of Virgin Media households showed that 74% of on-demand viewing occurred within two days of linear broadcast and 50% within a day. The operator added the BBC’s online catch-up service iPlayer to its on-demand service in June 2008, attracting nearly 100 million views that year, and ITV’s version, ITV Player, attracted over four million views in its first month since launching on the platform last February.

However, as KidsCo’s Robinson points out, consumers already expect catch-up TV to be free of charge, something that can perhaps be blamed on the increased usage of DVRs. “Catch-up TV is just another means of achieving the same consumer benefit, but there’s no appetite to pay,” he says. So where does this leave content owners and service providers? “Catch-up TV will continue to be free but a rich VOD offering sitting on top can attract revenue from consumers,” he adds. This could be particularly relevant to kids TV where parents might be inclined to give in to the demands of their children asking to watch extra episodes of their favourite programmes.

As far as MGM’s Marenzi is concerned, catch-up TV can be beneficial for all parties, although he admits that more needs to be done to monetise services in a way that rewards each part of the chain. “Catch-up TV is a great proposition for everyone. Customers watch programming when and where they want, broadcasters get more eyeballs and can tie their channel brand to the programme, and pay-TV operators see decreased customer churn through these services,” he says. “However, as the catch-up services evolve, we’ll need better ways to monetise it for broadcasters, studios and service providers.”

Many catch-up services are confined to, or were born on, the internet. Online on-demand services can be defined in various ways, including content uploaded to video sharing websites or content owners’ sites, broadcaster-controlled platforms such as the BBC’s iPlayer, pay-TV operator services including BSkyB’s Anytime or aggregated services like Hulu in the US.

[icitspot id=”9469″ template=”box-story”]

Turner’s Harwood says the most important thing for delivering long-form content online is for there to be a clear business model. “We tend to be platform-agnostic but we have to respect our business. In the UK, for example, it’s pay-TV and our online strategy has to follow that.” Along with many other broadcasters Turner has been active in delivering content to the iTunes store for consumers to buy. The same goes for Discovery. “We have a couple of short-form deals in the market. We are also working with a number of transactional operators – iTunes would be the primary example in the download-to-own space,” says Mitchell. Whilst perhaps not video-on-demand in the traditional sense of the word, the iTunes store is nonetheless becoming more popular with consumers and content owners alike and this could be one way for content owners to deliver programming outside operator-controlled networks with relative ease. Consumers are getting used watching content online and broadcasters are happy to re-use content on different platforms if it can make money. Matt Bowmen is commercial director of JCA, a company that works with broadcasters and content owner to prepare and manage content for various platforms, including online. He says that online on-demand platforms are starting to bed-in after a period when many launched but few proved successful. “It became a little bit overwhelming when a lot of platforms started popping up and people weren’t sure which ones would work. There was a fear that as a broadcaster you had to get on as many as possible to make an impact. Slowly but surely some platforms collapsed whereas others seem to be kicking up a gear.” He says that despite the technicalities involved with delivering content online seeming daunting to broadcasters, they are increasingly likely to use sites like iTunes to go directly to consumers. “I think a lot of the large scale distributors will start to go to down the business-to-consumer route. They can recognise the revenue stream and feel they can attract traffic because of their high-profile titles. It’s a new touch point to consumers and can make money,” says Mitchell.

Many broadcasters remain wary of parting with their valuable content without any obvious revenue streams. “We’re constantly evaluating all options but our content is extremely valuable and I’m not sure of anyone who’s been able to make a success of long form, ad-supported online services,” says Mitchell. “We’ll continue to focus on VOD plays that have more predictable revenues associated with them.”

VOD services will continue to roll out across a range of platforms over the next few years. If it is to become a mass market delivery platform that truly competes with linear channels, the challenge of how to monetise it in a way that offers significant returns will need to be resolved. For now, channel providers can see clear benefits in partnering with pay-TV operators rather than going it alone.