After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

CES 2017 round-up report

DTVE’s panel of industry experts discuss the big trends in media technology at this year’s Consumer Electronics Show.

Each year the Consumer Electronics Show offers a fascinating glimpse at what the tech industry has in store, as the weird and wonderful line-up to vie for the world’s attention. The 177,000-plus attendees that made the pilgrimage to Las Vegas earlier this month were treated to everything from triple screen-laptops to smart beds, by way of connected toasters and radiation-blocking pants.

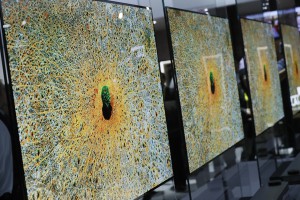

In the media and TV technology space, there was a lot to keep delegates interested. LG’s newest top-of-the-line Signature OLED TV W offered a ‘picture-on-wall’ design with the 65-inch model’s OLED panel measuring just 2.6mm thin.

Samsung, Sony, Panasonic and all the usual suspects in the TV space also showed off their newest and most impressive ultra high definition (UHD), high dynamic range (HDR) sets, while Amazon opened out its Fire TV interface and Alexa voice control functionality through TV deals with a handful of manufacturers.

In the virtual and augmented reality space, HTC introduced the Vive Tracker – a device that can be attached to any object to turn it into a VR controller that’s compatible with the Vive headset. Elsewhere, Intel unveiled its all-in-one VR solution, dubbed Project Alloy, while Lenovo drew attention by showing off a prototype for its first virtual reality headset.

We talk to a handful of industry experts about what caught their eye at this year’s show. Comments have been edited for length.

Ronan De Renesse, practice leader for consumer technology, Ovum

CES started with a much-needed injection of confidence in how well the VR market is doing. Samsung announced that it has sold more than 5 million Gear VR units so far and consumers watched more than 10 million hours of 360-degree videos in VR. Sony’s CEO, Kazuo Hirai, indicated that PSVR sales were on track with expectations and boasted 53.4 million PS4 unit sales so far, becoming by far the largest addressable base for dedicated home VR devices.

HTC Vive released and demonstrated a couple of new accessories for a better VR experience (TPCast, Vive Tracker, and Vive Deluxe Audio Strap). However, more interestingly, Vive is expanding efforts to open up its devices and development platform and app store Viveport to the enterprise sector.

Microsoft also built a strong presence at CES around VR and AR. It offered a few selected demos of its highly anticipated HoloLens headset, which was made available to developers in March 2016 for US$3,000. The first Microsoft Holographic headsets from Acer, 3Glasses, Dell, HP, and Lenovo were also unveiled at CES, but only the Lenovo device was fully functional. Despite being tethered to a PC, the new VR headsets offer a much more approachable version of home-dedicated VR to consumers and will be essential to drive adoption in 2017.

The lack of content continues to be a major roadblock to VR and AR adoption. Interestingly, after trying out both HTC Vive and Microsoft HoloLens, the ability to seamlessly move between AR and VR environments with the same device emerged as the most interesting application, which both are unable to provide at the moment.

George Jijiashvili, VR analyst, CCS Insight

Augmented and virtual reality were major themes at CES. One of the main highlights was Leap Motion’s hand-tracking VR technology; we found it particularly interesting and expect to see other headset makers integrating this feature in their devices in 2017. Other notable products included an impressive Fove 0 VR headset with eye-tracking capabilities – a feature other makers are also exploring; Daqri’s mixed reality headset made in collaboration with Intel for enterprise uses; and ODG’s R9 smartglasses, the first device powered by a Snapdragon 835 chipset, which aims to accelerate AR and VR experiences.

But the huge number of AR and VR solutions on offer was also a worrying trend that illustrated the main problem facing

this area: the technology isn’t making as much progress in software as it is in hardware. The selection of available content is currently very limited, potentially resulting in the hardware outpacing applications for the technology. The large range of accessories exhibited during the show means developers have to contend with a bewildering range of input options.

Nevertheless, some companies did showcase interesting applications for the technology: notably Flir, which used a VR game to showcase its heat visualising technology; NASA, which introduced some of its concept applications for AR and VR; and Intel, which provided several captivating VR experiences showcasing how live sports events, for example, can be recorded, streamed and viewed with its VR technology.

Steve Plunkett, CTO, broadcast and media services, Ericsson

One of the TV highlights of CES each year are the latest OLED displays. They offer beautiful colours and contrast inside incredibly thin panels. LG have long been the trailblazers in this category and their latest W7 models redefine what a thin TV is – with their slimmest model coming in at a mere 2.57mm. That’s thinner than a pound coin and makes the 7.1mm iPhone 7 look positively chunky. A number of other manufacturers also announced OLED sets for 2017 including Sony. Elsewhere in TV land, 4K displays were too mainstream to mention and HDR was pretty much standard across the board (in its many standards). Sony also displayed a very fine 4K laser projector, yours for a mere US$25,000.

Brian Morris, VP and GM global media and entertainment services, Tata Communications

“The raft of new 4K TVs and devices released at CES this week reinforces how the average viewing experience is becoming ever-more sophisticated and complex. This is great for consumers who get to see their favourite shows in better quality than ever before, and see new content produced for these new mediums and platforms.

“It also represents an exciting opportunity for content producers and distributors and broadcasters to push back the boundaries of TV. However, it also represents a huge challenge. They’ve gone from delivering TV programming through one method – broadcast TV – to delivering live and on demand content to mobiles, TVs and laptops across fixed networks and mobile, in HD, 4K (and soon in 8K) and HDR.

“Satellite and cable are no longer enough to provide the same high quality experience to viewers, however and whatever the viewer wants to watch. Increasingly they are coming to depend on the internet as a delivery method, as well as investing in ever-more sophisticated infrastructure like new connection points and protected fibre paths to handle this demand. This kind of investment is rapidly becoming the key differentiator for those who produce, distribute and broadcast content. After all, whether watching on their smartphone on the commute to work or on their 4K television in the comfort of their living rooms, viewers won’t wait if they can get something quicker and better elsewhere.”

Ronan De Renesse, Ovum

LG, Samsung, and Sony unveiled their new TV line-up for 2017 with 4K and high dynamic range capabilities. LG OLED Wallpaper TV sets stood out from a design and display quality perspective but won’t really affect the market share status quo between the top three manufacturers. Instead, more interesting developments occurred in the mid and low-end US TV markets with the launch of Amazon Fire TV Edition on 4K ultra HD TV sets from Seiki, Westinghouse Electronics, and Element Electronics.

Over-the-top video app and content partnerships have become a key differentiator in the high- growth mid-end segment. Tier-2 and tier-3 TV manufacturers do not have the expertise or resources to develop and maintain a proprietary TV operating system. Since 2014, TCL and Hisense have integrated the Roku platform into their smart TVs. Android TV hardware requirements are currently too high to serve that side of the market and this creates an opportunity for Amazon to move in. Roku is well established in that market and offers the largest number of OTT video channels in the US (more than 150). In addition, major US retailers such as Best Buy and Target are unlikely to distribute Amazon-branded TVs because the e-commerce giant is their largest competitor in electronics sales. Ovum expects US smart TV sales to reach 25 million units in 2017, a 12% increase on 2016.

What is happening with Roku, Android TV, and Amazon is very US-centric and unlikely to have an impact globally. Local content partnerships are difficult to scale and often better addressed by local service providers with their own competitively priced media streamers.