Are sports rights really heading for disaster?

Despite BeIN Media Group CEO Yousef Al-Obaidly’s explosive comments that the “media rights bubble is about to burst for sports” and that the industry is “sleep-walking towards a financial cliff”, broadcasters are showing no signs of slowing down in their pursuit of exclusivity deals.

Despite BeIN Media Group CEO Yousef Al-Obaidly’s explosive comments that the “media rights bubble is about to burst for sports” and that the industry is “sleep-walking towards a financial cliff”, broadcasters are showing no signs of slowing down in their pursuit of exclusivity deals.

The CEO, speaking at a Leaders in Sport Event, said that the company will drastically change its approach to sports rights and that “we now regard all sports rights as non-exclusive and our commercial offers will reflect that.”

Al-Obaidly’s particular brand of bitterness is likely informed in a big way by the effect of piracy on its business. It is no secret that Saudi-backed BeoutQ had the Qatar media company squarely in its sights, and it had a significant impact. In June, the company announced the layoff of 300 members of staff, and blamed the pirate outfit.

Efforts have been made to crack down on illegal streaming – including an EU cross-border effort to take down an international pay TV piracy network in September – but it is still rampant. A report from cybersecurity company Muso recently estimated that almost 180 billion visits were made to pirate sites in 2018 alone.

Dismissing a recent Rethink TV report that predicted the value of global sports rights would rise by 77% over the next six years as “crazy”, the CEO added that “any rights-holders who think that the technology companies of the West Coast are their financial saviours are going to be swiftly disappointed.”

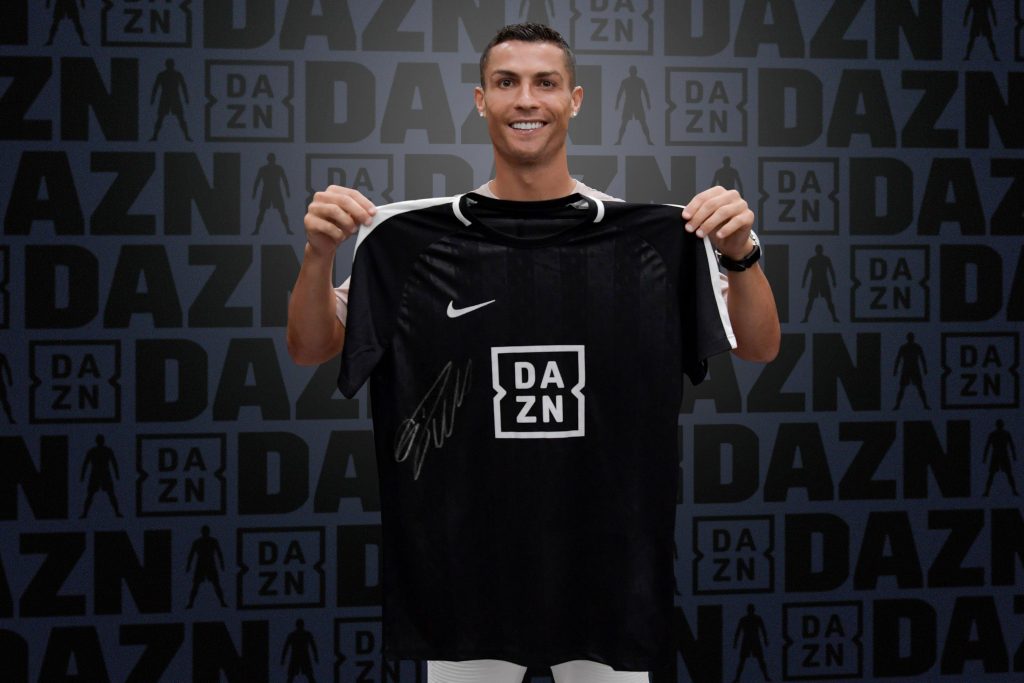

While it is headquartered in London rather than Silicon Valley, it is not a huge leap in logic to assume that one of the companies to which Al-Obaidly was referring was DAZN.

DAZN has implemented a variety of industry-standard DRM along with its own security tech in an effort to combat piracy. In an interview last year with SVG Europe, chief product officer Ben Lavender said that a combination of a VPN blacklist and geographic IP detection help, along with a low barrier to entry that “means that the effort required to pirate is not worth it”.

The streamer, which has most recently acquired exclusive rights to the Basketball Champions League in Spain, is continuing its rapid expansion, seemingly undeterred by the threats of piracy and the bubble to which Al-Obaidly makes reference.

In what has become something of a routine, DAZN has added to its already bulging portfolio of sports rights around the world. In Spain alone – a market in which DAZN has only been operating since February – it has already acquired the rights to over 40 leagues and competitions, including the English Premier League, MotoGP UFC and Copa América.

Also speaking this week was the company’s CEO John Skipper, who alluded to the UK being a “logical market” for DAZN.

This does not mean that BT and Sky need to brace themselves for disruptive impact any time soon, mind. Skipper added that in order to launch a compelling offer in the UK you “obviously need Premier League rights.” This would put a potential British launch at 2022 at the earliest, at the expiration of the latest round of Premier League rights sales.

The only “technology company of the West Coast” that is involved so far is Amazon, which has acquired 20 matches per season spread across two match days. Though it’s worth noting that the general reaction to this has ranged from treating A mazon’s simultaneous broadcast of 10 matches as a sort of curious experiment to consumer uproar over the addition of another subscription to worry about. And that’s before Amazon has even seen a ball kicked.

mazon’s simultaneous broadcast of 10 matches as a sort of curious experiment to consumer uproar over the addition of another subscription to worry about. And that’s before Amazon has even seen a ball kicked.

DAZN will likely be watching Amazon’s efforts with interest as it contemplates its next move.

The CEO did not just speculate on the UK however, but expressed doubts over Serie A’s proposed deal with Mediapro that should be announced either way on October 14 following a series of delays.

The proposed deal, which includes €55 million per season for copyright costs and €78 million per season for production, will also see the creation of a dedicated in-house channel for live games.

Skipper, the former president of ESPN, said: “We think an aggregated service that is localised for the market it’s in, and that has a good price value, is going to win. We don’t think single sports services are going to win.”

He went on to say that niche sports or league-owned OTT services are not the way forward, arguing that “it’s going to be multi-sport aggregation of the sports that people care about.”

There are multiple approaches to sports rights evident in the strategies displayed by the above players, but there are too many variables to say just yet whether Al-Obaidly’s comments are justified. Piracy clearly has had, and will continue to have, a significant impact on those holding sports rights. However, whether the increasing prices that have come about due to increased globalisation are a bubble about to be popped remains to be seen.