After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Ovum: Reshaping pay TV for the new reality

Ovum’s forecasts indicate that growth across all TV and video segments is becoming increasingly elusive for most competitors across both subscriptions and advertising. With digital platforms such as YouTube and Netflix dominating most markets, the size of the opportunity that remains does not augur well for most competing OTT video platforms.

Ovum’s forecasts indicate that growth across all TV and video segments is becoming increasingly elusive for most competitors across both subscriptions and advertising. With digital platforms such as YouTube and Netflix dominating most markets, the size of the opportunity that remains does not augur well for most competing OTT video platforms.

Major western hemisphere OTT markets are now maturing with penetration levels uniformly high, making growth contingent on audiences either adding subscriptions or dropping an incumbent, bathing the growth prospects for skinny bundles in a gloomy light. The battle for viewing time is just as unrelenting: YouTube and social platforms, alongside the Fortnite phenomenon, irresistibly command the attention of younger audiences. Evolving market growth in all types of video platform is increasingly focused on driving growth in mobile audiences, which changes the game again. Despite all this, competition is increasing, with Hollywood majors and broadcaster alliances launching new video platforms as well as the supremely well-funded (and hyped) mobile video innovation play Quibi.

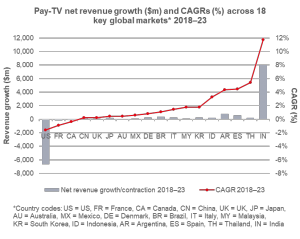

Pockets of growth exist in under-penetrated markets like India and Argentina, where we are forecasting strong growth to 2023. Pay-TV ARPUs globally are holding up remarkably well, and pay-TV service providers and broadcasters are – slowly – becoming more competitive in terms of content and usability. But the outlook overall for pay TV is negative: there will be fewer pay-TV services in the 2020s, but the ones left standing will enjoy, in most countries, a durable if stagnant market.

Pockets of growth exist in under-penetrated markets like India and Argentina, where we are forecasting strong growth to 2023. Pay-TV ARPUs globally are holding up remarkably well, and pay-TV service providers and broadcasters are – slowly – becoming more competitive in terms of content and usability. But the outlook overall for pay TV is negative: there will be fewer pay-TV services in the 2020s, but the ones left standing will enjoy, in most countries, a durable if stagnant market.

Maintaining competitive parity, if not advantage, requires pay-TV services to take decisive steps in adopting go-to-market strategies that will endure in this environment. Our upcoming report on “Reinventing pay TV for the 2020s” looks at these strategies in detail. They include picking where to compete for revenue and for attention, focusing content on fewer platforms, and enabling meaningful aggregation of differentiated content providers while offering an equally high standard of technical capability and quality of experience across all platforms. Facing up to the possibility that one’s market share makes longer-term survival unlikely will also be key for some – in which case a more fundamental pivot in strategy will be required – but for most, avoiding that scenario is the priority as we head into the 2020s.

Ed Barton is chief analyst, entertainment at Ovum.

Straight Talk is a weekly briefing from the desk of the Chief Research Officer. To receive this newsletter by email, please contact us.