After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Netflix is riding high, but must brace for inevitable post-lockdown churn

Netflix CEO Reed Hastings

If there is one company that is benefiting from the global lockdown, it is Netflix.

The streamer this week announced a quarterly increase of 15.77 million signups, a total that was over double its target of seven million and undoubtedly helped along by the ongoing global lockdown. Netflix even surpassed Disney’s market cap for a brief period last week.

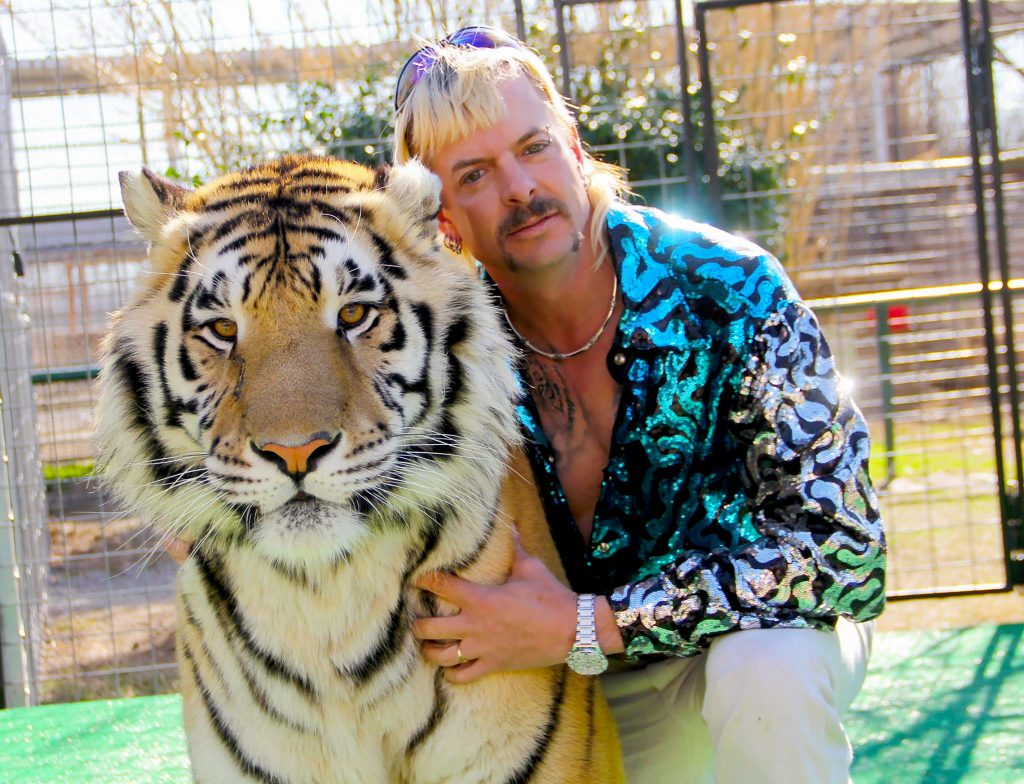

Netflix’s content is being watched in similarly astronomical numbers. Surprise hit docuseries Tiger King had been watched 64 million times, while dating show Love Is Blind was watched by 30 million users (an indication of a wider shift from SVODs towards reality television), and the latest season of Spanish heist thriller La Casa De Papel saw 65 million views.

Speaking on Ampere Analysis’s The Amp podcast, Tony Maroulis – principal analyst at the research firm – noted that this was the best quarter in the company’s history.

“Generally speaking Netflix has done very well, especially from a subscription perspective. From a revenue perspective the growth is perhaps a bit less strong and this is mainly for two reasons: firstly, a significant number of Netflix subscribers joined towards the end of the quarter as the coronavirus has spread, meaning that they only paid for one or two months of membership rather than full year,” he said.

“The other factor here is that the US dollar is generally gaining value against other currencies globally and this has meant that the value of an international subscription is declining.”

Maroulis used the example of Brazil where the price of the subscription has remained the same, but the streamer is earning 25% less per customer due to currency devaluation.

The majority of these new subscribers are from international territories. Seven million were from EMEA, 3.6 million are from Asia Pacific, while three million are from Latin America. The coronavirus effect was less pronounced in North America where Netflix already has high penetration and where the lockdown measures were introduced later.

The analyst added: “There already has been a large impact on Netflix’s business on the back of the COVID-19 pandemic, although from a financial perspective this has generally been positive. Netflix is very aware that the current global climate is very beneficial for its subscription growth and has highlighted that a likely slowdown in subscription growth is going to happen later in the year.

“Towards the latter stages of the year it’s likely that growth will definitely slow down and we might even see a small decline.”

This is something that Netflix is aware of, with CEO Reed Hastings admitting as much. During the company’s earnings call, Hastings called this period a “pull forward” of subscriber additions and cooled its subscriber expectations to 7.5 million for the second quarter.

In the company’s investor’s note, it said: “Hopefully, progress against the virus will allow governments to lift the home confinement soon. As that happens, we expect viewing and growth to decline.”

And therein lies the key challenge for streaming companies. Many like Netflix are exceeding expectations with signups (Disney, for example, recently hit 50 million sign ups for Disney+ less than five months after its initial launch), but these are extraordinary times and should not be taken as a sign of the long-term future.

Investors must be wary that the record numbers that we are seeing in terms of signups and viewing figures are likely to stay records for a long time. In other words, Tiger King is a compelling watch of real-world drama that is almost too outrageous to be true, but it wouldn’t have had 64 million views if people weren’t stuck indoors.

Hastings is right to suggest that this is a spike rather than a new sign of ongoing momentum, and Netflix et al. must, as Maroulis says, brace themselves for a period of relative famine once the world goes back to ‘normal’.

Churn is one of the biggest problems facing the industry at the best of times, but when lockdowns start to be lifted operators will have a real challenge on their hands.

For SVODs which pride themselves on hassle free month-to-month contracts, they will need to do enough in the coming weeks and months to convince users who signed up during the lockdown that they provide a compelling and vital service that has become essential to them.