After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Move over Succession, Zee’s true life media drama is even more compelling

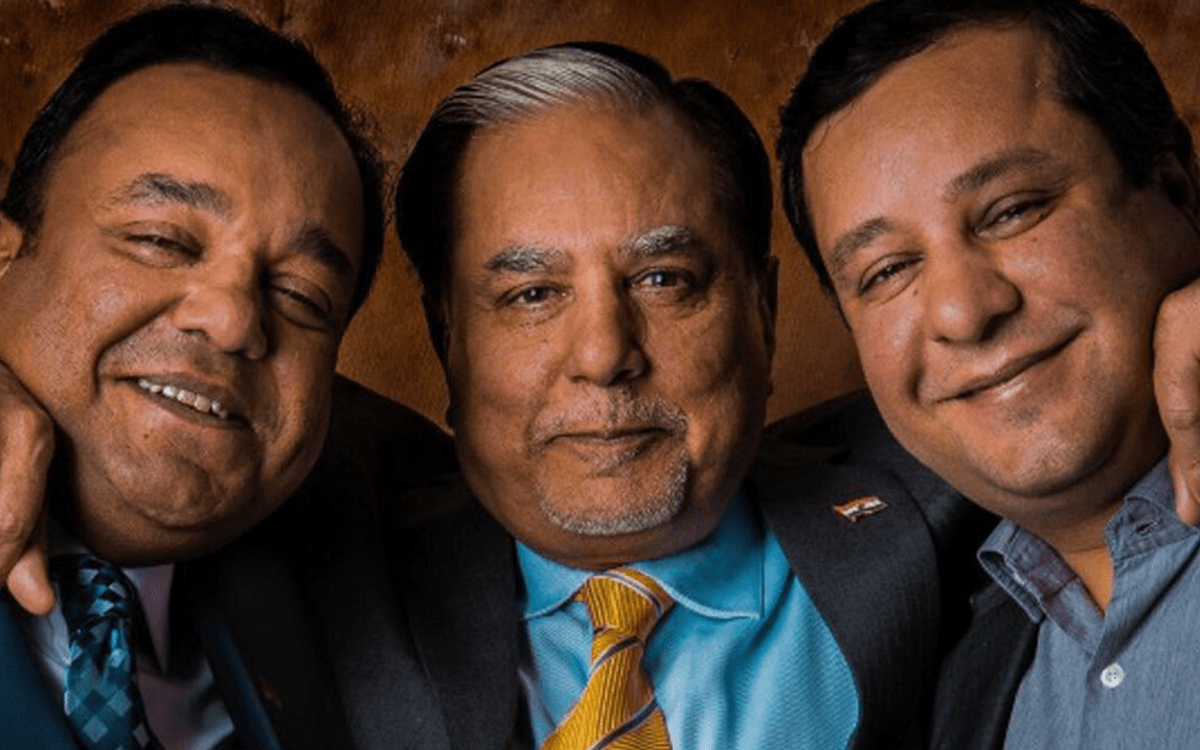

Punit Goenka, Subhash Chandra and Amit Goenka

When it was announced last month, the proposed merger of Sony Pictures Networks India (SPNI) and Indian media giant seemed on paper to be fairly straightforward.

Despite being second only to Disney-owned Star in terms of TV broadcaster share, Zee has experienced financial difficulties and has made no secret of its desire to merge with a major player.

Combining with Sony then seems to complement Zee’s business very well, Omdia principal analyst Constantinos Papavassilopoulos tells DTVE.

“Sony is very strong with sports content – becoming even stronger in 2016 when it acquired Ten channels from Zee when it wanted to exit the sports market,” the analyst notes. “Sony India is strong in sports and attracting a male audience, while Zee is strong in regional entertainment with India’s 22 languages and has a more female-skewed audience.”

He adds that Zee has been “looking for a partner for a long time.”

“The Indian market is very dynamic,” Papavassilopoulos says. “We see that in the online video area where we have over 50 OTT services, and even in traditional TV where there are between 5-8 million new TV homes every year. Size always matters, and everyone sees that the Indian market will go towards consolidation sooner or later.”

So a merger between Zee and SPNI to create an even bigger consolidated player is a straightforward case of a media company akin to what we have seen in the US in recent years in cases like Disney/Fox and ViacomCBS, right?

Well, not exactly.

Here enters a significant spanner in the works – Invesco Developing Market Fund.

Invesco, backed by OFI Global China Fund LLC, owns 17.88% of Zee’s shares and has vehemently stated its opposition to the proposed merger.

Things right now are on a knife-edge, with political and business intrigue dovetailing with big egos and even bigger sums of money. To the uninformed, this may sound like the plot of a certain high-stakes HBO drama, but I can assure you that this is anything but fiction.

Mixed motivations

Saying that the combination of SPNI and Zee would create a media giant would understate both companies’ pre-existing positions in the market. However, it would create an even bigger player that combines both companies’ linear networks, digital assets, production operations and programme libraries.

Omdia’s Papavassilopoulos says that a merger will give Zee/Sony a better position in what he dubs the “new battlefield of India” – the upcoming auction for the Indian Premier League (IPL) cricket rights.

The IPL is one of the world’s most-watched sports competitions. Its rights are currently held by Star, with the 2020 iteration of the competition watched for a cumulative total of 383 billion minutes while that season’s opening match attracted 200 million viewers. The rights are expensive but will be a kingmaker between Star India, Reliance-owned Viacom18 and the new Zee-Sony company.

“Everyone wants to get bigger and bigger,” Papavassilopoulos says. “Star is now one of the largest media and entertainment groups not just in India but in the whole of APAC with ambitions of exploring the Star and Disney portfolio of assets. Viacom18 is also very ambitious, with its chairman Mukesh Ambani being highly praised by Netflix co-CEO Reed Hastings as the man who started the internet revolution in India.”

However, above all the potential vectors for growth, arguably of most importance to Zee, which was founded by billionaire and media baron Subhash Chandra in 1992, is that the merger would ensure the continued influence of the founding family with Chandra’s son Punit Goenka continuing to serve as CEO.

The family currently owns less than 4% of Zee, but the deal with SPNI would enable them to acquire up to 20% of the new company if and when it generates the funds. Again, this is an area where Invesco has been critical of the deal as this aspect, it said, is “wholly opaque.”

Overall, it’s easy to see why Zee would go for a deal with Sony. It would increase its stature in the market and provide the financial backing from which it can better compete; and it would provide definitive backing to the Zee founding family while diminishing the influence of dissenting voices within the company.

The pushback

Invesco is understandably aggrieved at the prospect of this merger, particularly given that it revealed this week that it tried to facilitate a merger between Zee and the Viacom18-owning Reliance Industries earlier this year.

Responding to this news being made public, Goenka said that a deal with Reliance would compromise shareholder value and that “my attention was on the imbalance observed in the valuation and how it was not in the best interest of our shareholders.”

Papavassilopoulos believes that a tie-up between Zee and Reliance did not manifest due to a combination of finances and incompatible approaches to business, along with a key omission which did not work for the Chandra family.

“The Chandra family wanted to have a decisive say on the future of the entity, and the merger,” Papavassilopoulos notes. Simply, a merger with Reliance would not deliver this but a merger with Sony would. “To the best of my knowledge, that term was not on the table from the Reliance Jio proposed deal that Invesco was working on.”

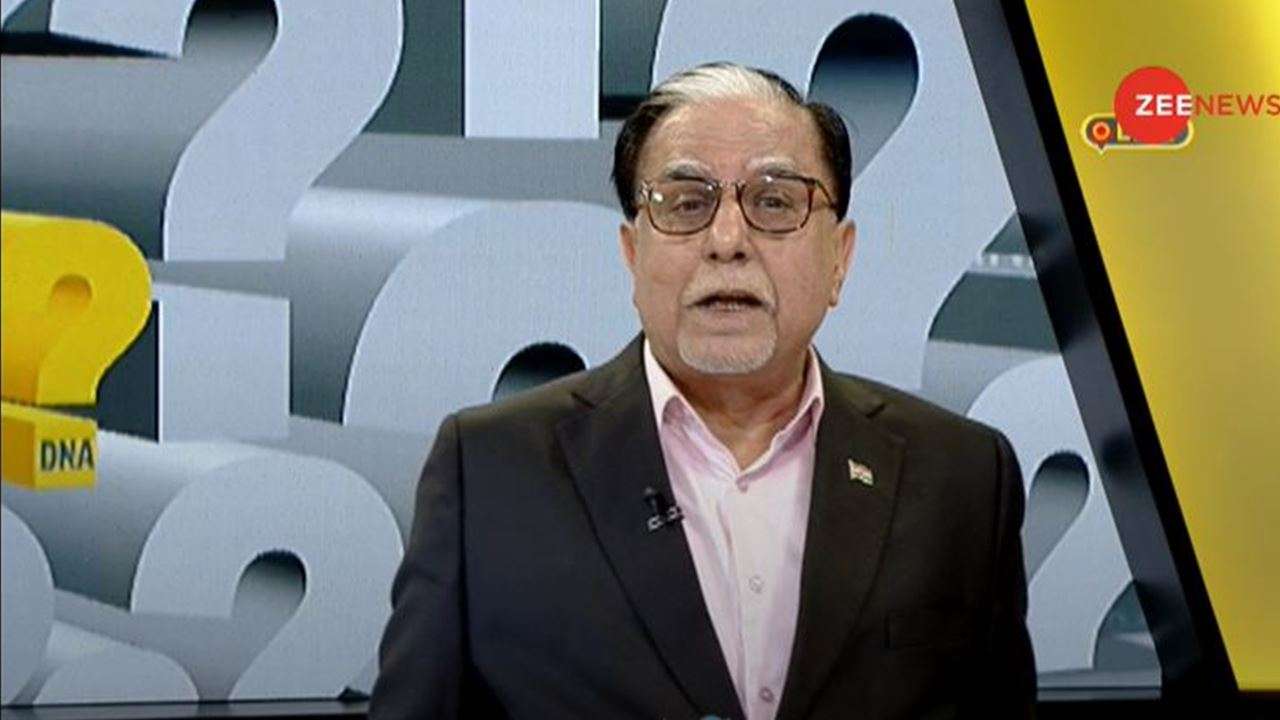

With Invesco pushing for a deal which would effectively see the family relinquish control, it is perhaps unsurprising that Chandra patriarch and Zee founder Subhash Chandra last week went on the company’s Hindi news network to accuse Invesco of plotting a hostile takeover.

He asserted: “What they (Invesco) are trying is to take over the company in an illegal way, hiding behind the provisions of the Companies Act. But the broadcasting sector is also governed by the Ministry of Information and Broadcasting (MIB) and there are clear rules for any takeover attempt.

“I will suggest that they come out and present their deal also in front of the shareholders. Let shareholders decide. They want to take over, fine, make an open offer to the remaining 75% shareholders and if they agree, buy them out. No one can stop you. But don’t try to do it illegally.”

In his appearance, Chandra also leant on the anti-Chinese tensions in India that have led to the banning of apps and services like TikTok. He argued that Invesco’s attempts to seize greater control of Zee will allow Chinese influence in the media.

Papavassilopoulos understands the position of the Chandra family. “Let’s face it, they believe that they should continue to have a say on Zee as they were the ones who made Zee such a successful media company in India over the last 30 years.”

Regardless of whether a merger happens with Sony, Reliance or anyone else, Invesco has made it plain that it does not want the founding family to be in control of Zee.

In an open letter to investors, Invesco chief investment officer, developing markets equities Justin Leverenz restated its demands to remove Goenka as CEO and instate a restructured board.

He calls the Chandra family’s dealings a “reckless public relations campaign,” and says: “These actions and rhetoric are aimed at avoiding true accountability for the governance lapses and shareholder value destruction that the current leadership and Board have presided over. We are calling on Zee shareholders to join us in asking why the founding family, which holds under 4% of the company’s shares, should benefit at the expense of the investors who hold the remaining 96%.”

Ultimately, Papavassilopoulos believes that a Zee merger will happen. “The real question now,” he states, “is if it’s not going to be Sony, are Viacom18 and Mr Mukesh Ambani ready to jump in and be the next partner after the Chandra family is ousted from running the company?

“This is a big game in the Indian media and entertainment sector. One of the largest media operators is desperately looking for a partner. Viacom18 is very well connected with the Modhi government. If that is enough for them to derail the Sony-Zee merger, it remains to be seen.”

The analyst concludes: “At the moment, there is a greater probability – even if it’s 52:48 – of the merger going through so I expect we will have a deal between Sony and Zee.”

It is quite fitting that this is all ongoing in the days building up to the return of HBO’s hit series Succession – a series where a family unit vies with itself and the wolves at the door for control of the fictional Waystar-Royco. But while the sensationalised and sweary tale of the Roys makes for compelling viewing of a Sunday night, sometimes true life dramas can be just as gripping – and have real world ramifications for an entire industry.