After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

In the attention economy, YouTube is the king of video

It is of little surprise that YouTube is a huge money maker for Google.

The video platform is the second most-visited website on the internet behind only Google itself, and registers 2 billion monthly active users including 120 million who watch on their smart TVs.

All of that translates to a significant amount of money made for parent company Alphabet from ad sales. In Q2, the platform generated US$7 billion in ad revenue for Alphabet, up 83% year-over-year.

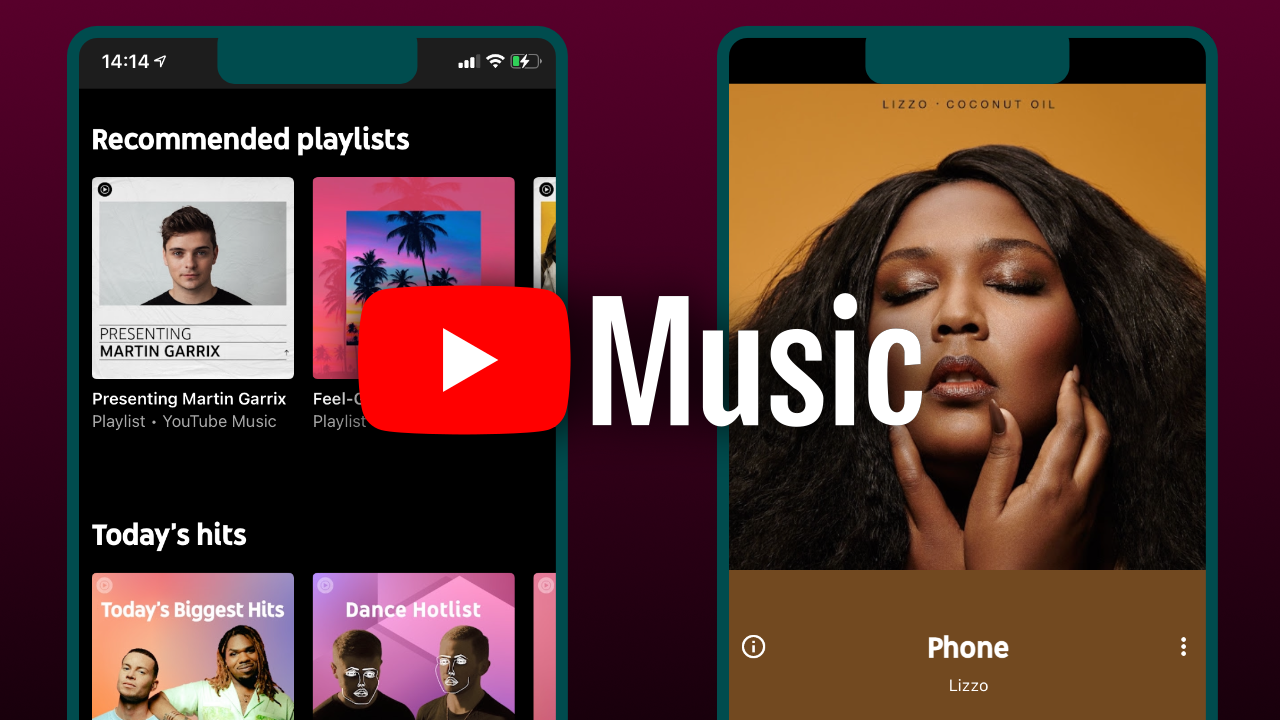

But while the historical focus of YouTube has been its ad business, this week’s announcement that the platform’s paid-for offerings – YouTube Music and YouTube Premium – had reached 50 million subscribers shows that it is a bonafide player in the SVOD world as well.

YouTube has not provided a breakdown between Music and Premium in terms of those 50 million subscribers, but Omdia senior analyst Max Signorelli points out that the vast majority of these subscriptions come from Music while “the full Premium subscriptions with video benefits are effectively a minor increment on that.”

However, we live in an attention economy and, as Netflix co-CEO Reed Hastings once pointed out, video platforms are in competition with one another as much as they are with videogames like Fortnite and other forms of entertainment.

For YouTube, the priority is ensuring that it can be at the forefront of consumer attention whether that is as a music streamer or a video platform – this is largely why it has been such a success.

Impressive growth

In less than a year, YouTube’s premium services have almost doubled in subscribers – growing from 30 million at the end of 2020 to 50 million in September 2021.

To put it into context, during that time Netflix has seen its subscriber numbers increase by a fraction of that amount from 203.66 million to 209 million at the end of Q2 (we await Q3 figures). A newer player, Disney+, has jumped from 73.7 million in Q4 2020 to 116 million in Q3, but it is worth considering that the streamer’s business is solely based on subscriptions with no ad revenue and a subscription to Disney+ is the only way of consuming content from the platform.

The consumer reasons for subscribing to the platform’s paid service are straightforward: YouTube Music (US$9.99 per month) allows users to listen to and download ad-free music, while YouTube Premium (US$11.99 per month) extends the ad-free viewing and download capabilities to all videos on YouTube. Both also allow mobile users to listen to audio in the background while the app is minimised.

Such a no-frills set of features evidently is value enough for millions to sign up for the respective services –

Omdia’s Signorelli attributes a significant portion of this surge in growth to the merger of Google’s services. “Merging the music service from Google Play Music with the extremely well established YouTube platform has served Google’s media services well,” he says. “This is somewhat similar to its transactional video service which can also be accessed through YouTube.

“This all said, while the service is growing in subscriptions quickly, these blended Music and full Premium subscriptions are still far behind music services like Spotify or other paid video services.”

The analyst also points out that while YouTube’s subscriber growth is impressive “YouTube Premium isn’t designed to compete with the likes of Netflix – YouTube doesn’t need to invest so much in it’s own content as the YouTube platform serves as a lifeline or significant distribution centre for all kinds of content, including Music.”

Complementary businesses

YouTube heavily markets its premium services to its users, particularly via its mobile app where the benefits of the subscription options are, but there is little overarching sense that YouTube is urging people to pay for the service if they’re happy with ads.

Unlike a service like NBCUniversal’s Peacock which holds back more lucrative content like sports rights and top-tier shows like The Office for its premium subscribers, nothing is off limits for YouTube users.

Despite a brief failed flirtation with paywalled content when YouTube Premium was known as YouTue Red, both paid and free YouTube users have access to all the same videos.

Part of this is due to the nature of YouTube’s content. Major broadcasters may upload clips and even full episodes of shows to the platform, but the vast majority of content is produced either by smaller teams or solo creators – and there are more than 2 million of those registered under YouTube’s Partner Program.

Even larger media companies like Buzzfeed and Vogue with its wildly popular 73 Questions With celebrity interview series, are producing content for YouTube as an extension of their digital brands rather than to sell to broadcasters.

Even larger media companies like Buzzfeed and Vogue with its wildly popular 73 Questions With celebrity interview series, are producing content for YouTube as an extension of their digital brands rather than to sell to broadcasters.

For a creator on the platform, there is little difference to them between premium subscribers and free viewers. They generate revenue for themselves based on views and sponsorship deals brokered externally from YouTube, while a recent deal with ad measurement firm Comscore should give all involved a more granular perspective on viewers. This more agnostic approach

Ultimately, YouTube is in a league of its own as a video platform– perhaps more so than its parent company Google.

While some make the case for alternative search engines that have different practices, it would be hard to argue that there has been any major competition to YouTube in the west.

“YouTube was a front-runner in this space,” Signorelli states. “It has established itself as the world’s largest video platform and is a hub for everything from user-generated short-form content to highly produced series from professional networks, many of which spawned through the platform.”

Amazon-owned Twitch has perhaps taken part of YouTube’s video share when it comes to gaming-related content and livestreams, but the numbers don’t lie and YouTube is still undoubtedly top of the tree.

YouTube is, as pointed out, not a direct competitor to Netflix and Disney+, but at a time when the overwhelming priority for operators is to keep users on their platform for as long as possible, few do it better than Google’s video site.