After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

How will the UK’s cost-of-living crisis impact consumer video spending?

It has been difficult to avoid stories about the UK’s cost-of-living crisis in recent times, but this week’s news that the rate of inflation had increased to a 40-year high of 9% has made it unavoidable.

The impact of this has been felt across every industry, and while the media and entertainment sector is a relatively superfluous one when struggling families are seeking refuge in fast food restaurants it is still something necessitating discussion.

It is a simple fact that when times get tough financially, the easiest things for households to cut back on are entertainment. Trips to the cinema, for example, had already been curbed by the covid-19 pandemic, but lower income families will likely be even more selective on if and when they take a trip to see the latest blockbusters. (This hasn’t stopped the latest Marvel Studios film Doctor Strange in the Multiverse of Madness from making over £30 million at the UK box office, mind).

But closer to home the relative ease of swapping subscription video services in and out will make them have to prove their value to consumers.

As Omdia analysts Irina Kornilova and Marija Masalskis posit: “As utility bills and food prices rise, will Netflix and other M&E firms need to warn shareholders about competition for a resource that’s set to get scarcer than consumer attention: household budget?”

SVODs set to prove their worth

One likely outcome from the current financial situation is an acceleration away from purely subscription-based models for streaming.

As I previously discussed earlier this month, you’ll be hard-pressed to find a major SVOD in the coming years that doesn’t offer an advertising-supported model. Netflix, once a company that said it would never consider adding ads, could offer its ad-supported product before the end of the year while Disney has provided an outline of how its ad business will be structured for Disney+.

These are global and largely US-oriented shifts being seen across the industry, but operators may look to accelerate these plans for the UK, which Omdia says is “likely to be one of the economies hardest hit by the rise in cost of living”.

But while columnists around the world have written about Netflix’s subscriber losses, even with increasing prices they still present a remarkable value for money when compared to the physical media consumption of previous decades.

Omdia’s analysts believe that SVODs should fare well and “cement their popularity, thanks to the all-you-can-eat value they offer,” but they warn that “many consumers may look to reduce their overall spend, by switching to lower-tier packages or discounted family plans, swapping services in and out to access specific content or cancelling contracts where they have multiple subscriptions, such as online video.

“Households subscribed to multiple services are likely to think harder about which are essential and which they can afford to swap in and out or cancel altogether.”

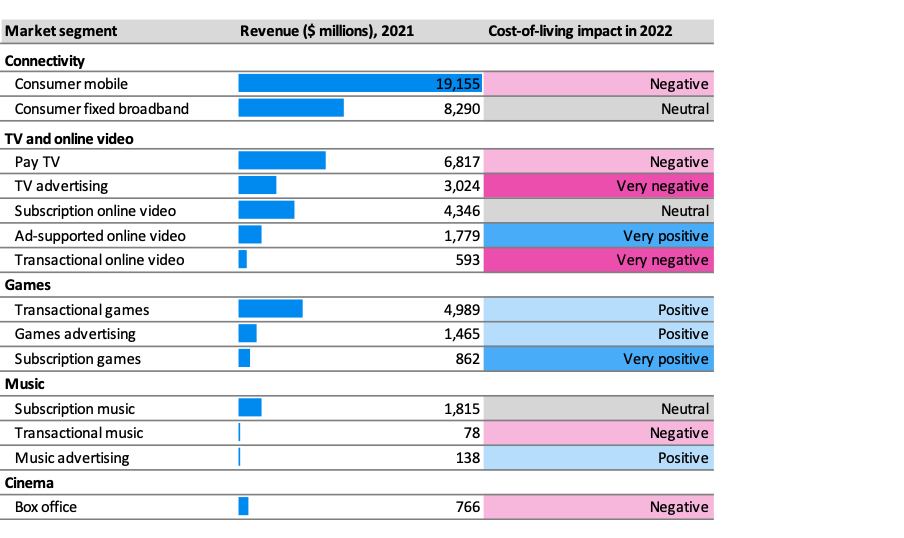

Ultimately, the research firm estimates that the cost-of-living crisis is “likely to be neutral” for SVODs, with any losses that come being countered by shifts elsewhere in the market.

Shifts elsewhere in the market

While SVODs should come out of all this okay, the same cannot be said for transactional video on demand (TVOD) offerings and pay TV operators.

“Pay TV components may bear the brunt of consumers’ attempts to reduce overall spend, as larger bouquets of channels and content are seen as less essential than connectivity,” Omdia analysts note.

Not that they would have done this in anticipation of a potential recession, but pay TV operators like Sky and Virgin Media O2 will be thankful for their investments in aggregation with platforms like Sky Glass and Stream.

But outside of purely offering pay TV services that consider streaming, Omdia notes that “the damage to pay TV will be softened by the power of subscriptions and, in particular, bundles featuring utility-like home broadband and mobile services with long contract terms.”

In regards to transactional purchases of series and films from platforms like Amazon, Apple and Rakuten, Omdia predicts that the cost-of-living crisis will have a “very negative” impact.

This again is a logical deduction – when counting the pennies, spending anywhere from £5-15 to buy or rent a single film does not seem like good value, underlining just how much bang your SVOD buck gets.

The one clear winner with no frills for consumers will be free ad-based platforms like Pluto TV and Amazon’s Freevee (formerly IMDbTV).

“The impact on ad-supported online video is likely to be highly positive,” Omdia states. “Services performed well during the COVID-19 pandemic, and we expect that to continue through this recession. There’s huge potential for TV ad dollars to shift online, as consumers’ appetite for watching ad-supported video grows and big media firms position their premium services as TV 2.0.”

Omdia notes that “digital advertising will continue to flourish,” with brands increasingly shifting away from traditional TV advertising and towards online.

The analysts add “Those same big brands will look to digital as a more cost-effective means to reach consumers and drive sales than traditional ads. For the long tail of small and medium-sized advertisers, digital advertising will become increasingly critical to their very being.”

Though it would be easy to argue that entertainment is a frivolity when people are facing genuine hardships, as during the pandemic, Brits will look towards video as an escape and as a means of “creating social connections” as Omdia puts it. One of the best aspects of the TV industry in 2022 is that there are options available for all budgets, and consumers will look to make the most of these options even as their purse strings tighten.