After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

How does the set-top box fit in with the streaming future?

The set-top box has been the workhorse of the pay TV industry for decades.

But the popularity of streaming services – as evidenced by the 1 billion-plus SVOD subscriptions reached in 2020 – shows the need for operators to adapt quickly to new circumstances and deliver services to devices other than TVs within a specific network footprint, as well as increased competitive pressure and cord-cutting.

One approach is to allow consumers to view a service via a device they own, whether that is a streaming box from a third-party supplier or a smart TV.

The challenges for operators relying on a ‘bring-your-own-device’ (BYOD) approach include maintaining their branded presence in consumers’ homes, finding effective ways to monitor network performance and consumer behaviour, and deliver advanced services to devices over which they have no control.

As a part of the Digital TV Europe Industry Survey 2021, we questioned industry insiders, principally pay TV operators and broadcasters, OTT streaming companies, content creators and aggregators, regulators and technologists about their views on the future of the set-top box and to reflect on the advantages and disadvantages of BYOD, as well as to identify possible alternative ways to deliver advanced services and maintain consumer engagement.

The value of the set-top box

Despite the advance of streaming and its conquest of consumers’ wallets and eyeballs, the set-top box remains the technology workhorse of the pay TV industry. However, this is changing as operators look to embrace OTT and cloud technology, as part of a move to make video delivery all-IP-based. Operators are increasingly seeking to deliver to multiple screens using a single platform and extend the reach of services to subscribers outside the physical footprint of their fixed network infrastructure.

Some 10% of our respondents believe that the box is absolutely central to the TV operator proposition and is here to stay. Among the remainder, 35% believe that the set-top is a useful element in the TV operator’s proposition but is not irreplaceable, while a further 36% take the view that it is only one option the TV operator has to reach customers today and is no more valuable than any other.

A minority (19%) see the set-top as already out of date and that it constitutes an unnecessary, fast-depreciating asset on the balance sheet.

From these results we can see that a majority of respondents believe the box has some value but only as one of a number of ways to deliver video to their customers. Most respondents recognise that consumption patterns are changing and that the box will not necessarily be around forever, particularly as operators study alternative ways to find their subscribers.

Ultimately, The set-top is still an important tool for TV operators. However, consumption patterns are changing and the box will become less central to their proposition over time.

A BYOD future?

For operators that provide a TV service along with broadband and telephony, the main alternative to investing in set-top boxes is to adopt a bring-your-own-device (BYOD) strategy whereby subscribers can buy a connected device and hook it up to the network. This could include delivering services directly to smart TVs.

Typically, operators will strike a deal with a retail device supplier to market such devices or smart TVs direct to their user base, as a number of service providers have done with Apple TV or off-the-shelf Android TV devices, or with specific smart TV manufacturers.

Other devices that could be used in this context include game consoles or streaming sticks of various types. The advantages of this approach include avoiding the cost of investing in set-top boxes and removing an installed base of such devices from the company’s balance sheet. Operators can also lean on the marketing power of global tech giants to market devices with recognised brand equity.

On the downside, such an approach could reduce the operator’s service to ‘just another app’ on someone else’s device, watering down the engagement that subscribers have with their service provider. It also means that operators are reliant on the functionality and software upgrades provided by third-parties and it may mean they have less control over their customer data.

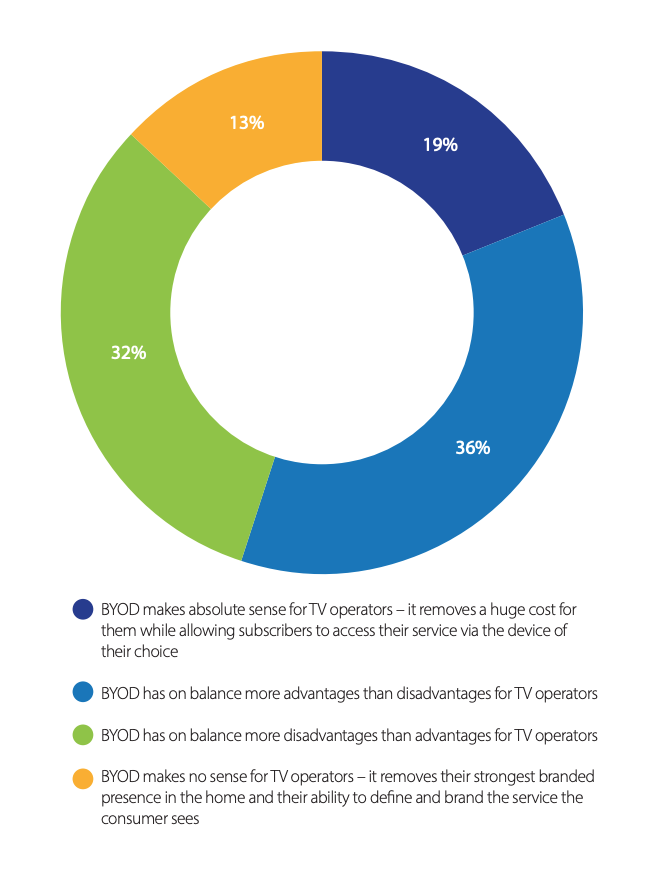

For survey respondents, a majority believe that BYOD on balance makes sense to a greater or lesser degree, with 19% believing this approach makes absolute sense and a larger group of 36% taking the view that advantages outweigh disadvantages.

Among the BYOD sceptics, 32% of the remainder of the survey sample believe that BYOD carries more disadvantages than advantages, while a smaller group of 13% believe that BYOD makes absolutely no sense.

These results perhaps reflect the fact that while BYOD has gained ground among pay TV service providers, with a number adopting it as an alternative way for a segment of their user base to access their service, few have adopted a BYOD-only approach across their entire base. That approach remains largely confined to pure-play streaming companies, rather than those either selling a complete pay TV line-up that includes some third-party content or selling pay TV as part of a multi-play proposition.

BYOD as a footprint for advanced TV Services

The attractions and disadvantages of BYOD are intricately bound with the specific objectives of the operator. What works for one business model may well not work for another. Opinion may also be divided over how well this type of approach works for any given business model.

We asked survey respondents to consider the relative merits of six strategies for pay TV operators to optimise the delivery of advanced services. Our survey sample was generally positive about BYOD as a way to deliver advanced services, but also rated some set-top-based strategies as effective.

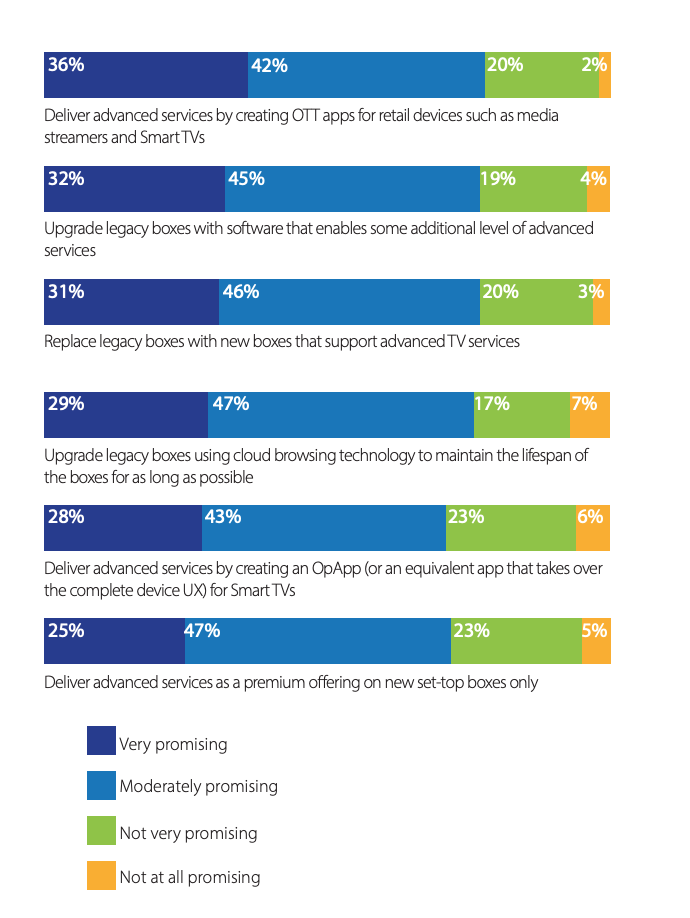

The most approved approach was to deliver advanced services by creating OTT apps for retail devices such as media streamers and smart TVs – an approach that dovetails seamlessly with a BYOD strategy.

This BYOD-centric approach came ahead of two alternative set-top-centric strategies that were more or less equally rated. The first was to replace legacy boxes with new devices that support advanced TV services. This wholesale replacement of an installed base is certainly a radical option, but one that is not available to many service providers, given the cost.

A replacement strategy was rated equally with a more modest strategy that was also set-top-centric: upgrading legacy boxes with software that enables some additional level of advanced services. One variant of this approach – to upgrade legacy boxes using cloud browsing technology to maintain the lifespan of the boxes as long as possible – was also given a relatively high rating.

The remaining two strategies were rated similarly, with respectable majorities also giving them ‘very promising’ or ‘moderately promising’ ratings. One was to deliver advanced services as a premium offering on new set-top boxes only – an approach that may or may not work depending on the competitive environment facing the operator.

The other approach considered was to deliver advanced services by creating an OpApp (or equivalent app that takes over the complete device UX) for smart TVs. This approach has the merit of enabling service providers to control the UX and preserve its brand while liberating it from the need to invest in advanced set-top boxes.

Somewhat underrated as an approach, OpApp enables service providers to deliver an advanced UX and maintain a strong branded presence in consumers’ homes while avoiding investing in set-top boxes.

The future of the set-top

In the view of respondents, the set-top is still a powerful tool for TV operators to deliver services to their subscribers. However, they recognise that consumption patterns are changing.

A majority of respondents think that BYOD is a viable strategy for operators, although there is some concern about the loss of control that this may entail.

Operators with large bases of legacy set-tops face the challenge of how to deliver the advanced services and functionality that consumers increasingly demand. A range of options are available to deliver advanced services, including simply creating OTT apps for retail devices – an approach that survey respondents found appealing.

Alternative ways of delivering advanced services include a wholesale set-top replacement strategy, restricting advanced services to a smaller range of premium-tier devices, upgrading legacy boxes with new software or using cloud technology to maintain the lifespan of devices. However these approaches are either extremely costly or limited in scope.

The set-top box is an intrinsic part of the TV viewing experience in 2021, but as consumption habits continue to change operators must remain diligent to keep up with the wants and needs of their customers.

This piece is adapted from a section sponsored by Vewd in the Digital TV Europe Industry Survey 2021. To read the full report for free click here.