After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Can discovery+ live up to its promise as ‘the definitive product for unscripted storytelling’?

2021 has started with a bang for Discovery.

Ending the year by announcing the global roll-out plans for its SVOD discovery+, the company launched the streamer in the US and MENA this week as it looks to flex its ‘SUV’ of a service. In addition, Discovery has also started the year by announcing a 12-country distribution deal with Vodafone.

This all follows an initially understated launch in the UK in November, which also leaned on a distribution partnership with Sky which gives premium Sky Q customers free access to the service for a year.

What’s already evident is that Discovery is taking a different approach to the rollout of its streaming service to its peers, and one which will be looked at closely in the coming months.

What is discovery+?

The latest in a surfeit of streaming services from US-based media giants, discovery+ is the factual broadcast company’s answer to the likes of Netflix and Disney+ with an ambition to be “the definitive product for unscripted storytelling.”

However, in terms of content, discovery+ could be said to have more in common with CuriosityStream – the startup SVOD which was launched in 2015 by Discovery founder John Hendricks and has more than 13 million users worldwide. While the comparison is apt in some ways, discovery+ serves more than just the educational mindset of CuriosityStream, and arguably has a greater focus on unscripted entertainment shows like Say Yes to the Dress and Extreme Makeover: Home Edition.

However, in terms of content, discovery+ could be said to have more in common with CuriosityStream – the startup SVOD which was launched in 2015 by Discovery founder John Hendricks and has more than 13 million users worldwide. While the comparison is apt in some ways, discovery+ serves more than just the educational mindset of CuriosityStream, and arguably has a greater focus on unscripted entertainment shows like Say Yes to the Dress and Extreme Makeover: Home Edition.

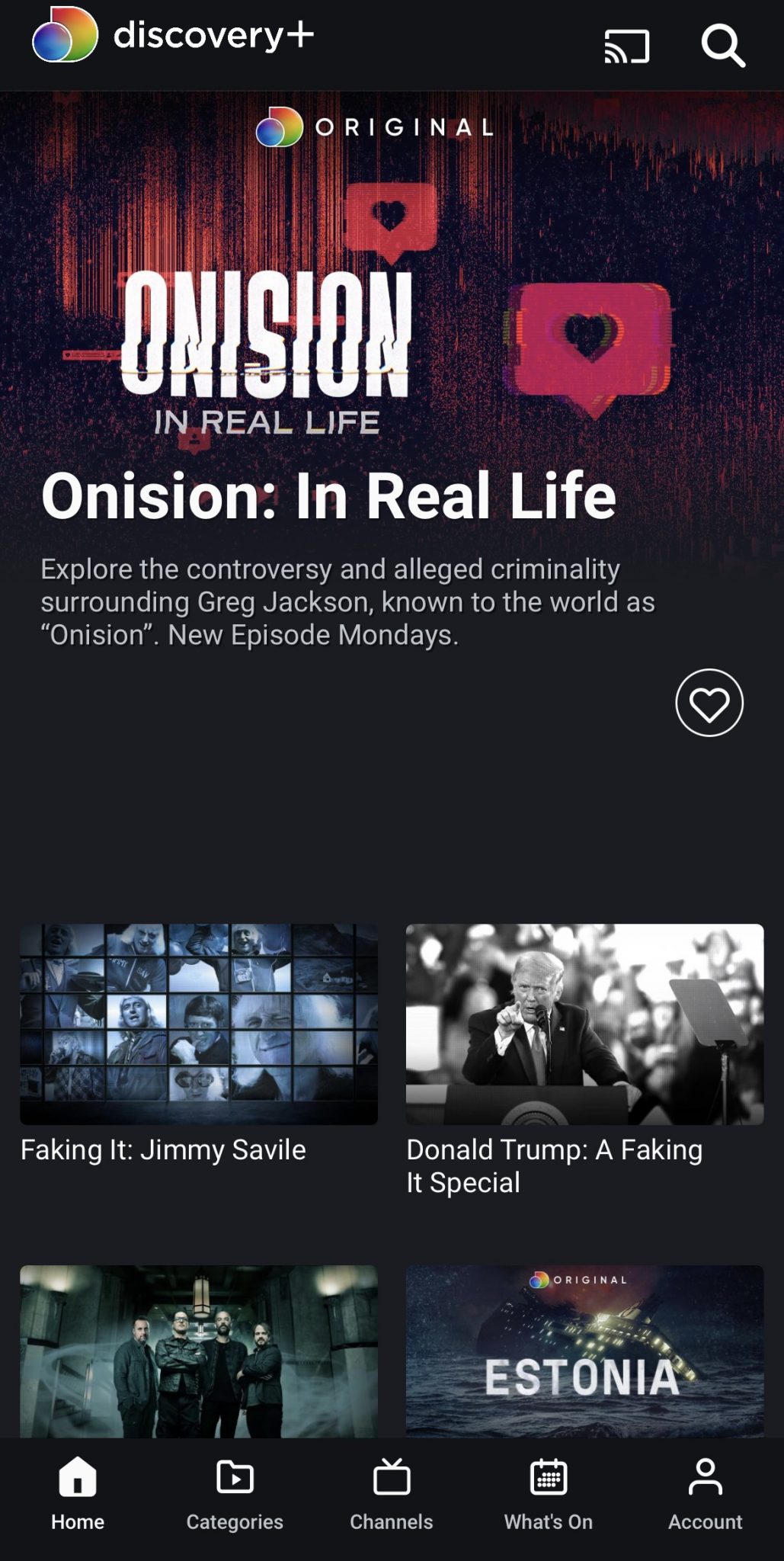

Claiming to launch with the most content of any new streaming service, the SVOD starts its life with 55,000 episodes from 2,500 shows from brands like HGTV, Food Network and, of course, Discovery. Also offered are a number of exclusives, ranging from standalone discovery+ series like Chasing Ocean Giants to special editions of staple shows such as Faking It.

While it seems to be the latest off the production line of premium SVODs, the service is not a reaction to the market trend of broadcasters offering standalone streaming platforms. Discovery CEO and president David Zaslav, speaking at the December rollout reveal, said: “We have been working methodically the past two years to bring all of our strategic advantages to the launch of discovery+, including distribution and advertising partnerships around the world, a world-class offering of quality brands, authentic personalities and the largest content library at launch, as well as a broad slate of exclusive programming.”

An intriguing twist to discovery+ in Europe (outside of the UK) is that it will be the streaming home of the delayed Tokyo Olympics should they go ahead this summer, with Eurosport holding the rights to the Games.

Don’t expect discovery+ to become a surprise DAZN killer however. Eurosport’s president Andrew Georgiou last month said that while the Eurosport Player will eventually be folded into discovery+, the service will lean more into documentary and behind-the-scenes shows than live sports rights. GolfTV and Global Cycling Networks, for example, will remain in operation as standalone services.

A strategy for success?

Discovery is being swift in rolling out the service, but simultaneously methodical in its strategy as it evaluates the needs of each market and formulates distribution deals in each to give it maximum exposure from the off.

This strategy was evident from the initial UK launch in November. Drawing a parallel with Disney, when it announced a distribution deal with Sky in March of last year, Discovery has gone one step further in offering the service for free to Sky Q users for 12 months – presenting a no-frills saving of £49.99. Even if only a small number of Sky Q’s millions of UK users convert to paying subscribers it will be considered a successful experiment.

And we are seeing this echoed in the US with a deal to give Verizon’s 55 million mobile users the same offer. The Vodafone partnership in Europe meanwhile lays the groundwork for similar launch plans across the continent, and gives Discovery access to what Zaslav described as “Vodafone’s vast and deep consumer relationships” which “will provide a powerful engine for discovery+.”

And we are seeing this echoed in the US with a deal to give Verizon’s 55 million mobile users the same offer. The Vodafone partnership in Europe meanwhile lays the groundwork for similar launch plans across the continent, and gives Discovery access to what Zaslav described as “Vodafone’s vast and deep consumer relationships” which “will provide a powerful engine for discovery+.”

But rather than rushing out the gates across the whole of Europe, Discovery will instead take its time to rollout to more than 25 key markets including the Nordics, Italy, the Netherlands and Spain in 2021 and 2022.

However, Discovery has also shown itself to be flexible and not overly precious about discovery+ as a standalone product. Unlike WarnerMedia and NBCUniversal, Discovery has quickly sorted a deal with Amazon which will in turn see the SVOD offered on Prime Video Channels, and discovery+ also launched on Roku devices when it was switched on in the US this week.

Across in the Middle East, the company has partnered with Starzplay in a deal which recognises it as the MENA region’s de facto streaming leader. In what is sure to be a lucrative deal, discovery+ will launch as a dedicated branded area within Starzplay at no extra cost for its one million-plus paying subscribers.

Discovery’s entire ethos for discovery+ is perhaps best encapsulated by its senior business development and distribution director of the Middle East, Africa, Turkey and North East Europe, Francesco Perta, who said: “Our vast content library gives us a running start to serve fans directly in markets across EMEA, and the world, in ways that are relevant, compelling and tailored to each market.

“Our partnership with Starzplay is another example of how we are scaling our DTC businesses by leveraging our combination of competitive advantages – content ownership, brand strength and the biggest global footprint in media.”

Whether this distribution arrangement is down to a lack of faith in the region’s appetite for discovery+ as a standalone service, or an acknowledgement that Starzplay gives it the best exposure, Discovery is showing flexibility in its approach.

It is clearly early days for discovery+, but the company is evidently very serious about the service – at least more serious than it was with dplay, its earlier streaming offering which arguably failed to make much of an impact on the streaming landscape.

A significant amount of investment in content and platform development, along with an industry-leading library of unscripted content, gives discovery+ a unique position in the market. Now that it is out in the wild, we will have to see if it is able to reach an audience that is willing to pay for the service in the coming years.