After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Samsung continues to dominate CTV device market

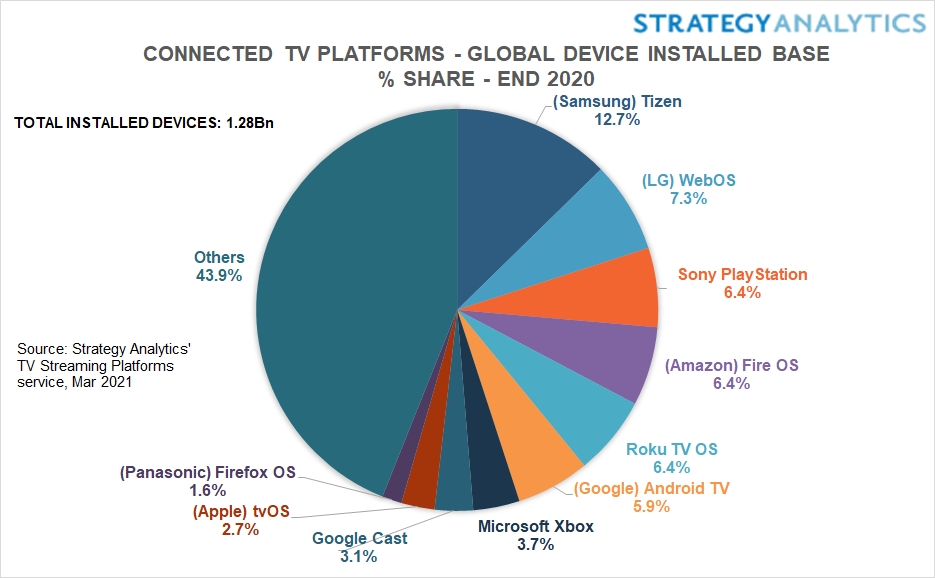

The Samsung Tizen smart TV OS further extended its dominance in the CTV market as the top platform.

According to Strategy Analytics, the number of Tizen devices in use worldwide increased by 21% year-on-year to 162.3 million in 2020. This makes Samsung’s platform the most used by a significant margin.

LG’s WebOS is sat in second place with 7.3% of the market, while Sony PlayStation, Roku TV OS and Amazon’s Fire OS are tied with 6.4% of the CTV installed base.

However, while Samsung sits atop the pile, other operators are growing more rapidly. Google’s Android TV increased by 42%, while Roku TV OS increased by 40% and Amazon’s Fire OS grew 35%. The growth of these vendors is less surprising, given their high profile product launches in 2020 such as the new Chromecast with Google TV.

Overall, the total number of TV streaming devices in use worldwide increased by 122 million in 2020 to reach 1.28 billion.

The report predicts that Samsung will add another 184 million devices during 2021, while Google, LG, Roku and Amazon will all battle to catch up.

While Samsung is leading in 22 of the 25 countries surveyed, there is significant regional variation in platform usage. In the US, for example, Roku is by far the dominant CTV player thanks to its low-cost smart TVs and streaming devices. There, the company commands 20% of the country’s market.

While Samsung is leading in 22 of the 25 countries surveyed, there is significant regional variation in platform usage. In the US, for example, Roku is by far the dominant CTV player thanks to its low-cost smart TVs and streaming devices. There, the company commands 20% of the country’s market.

David Watkins, Director, TV Streaming Platforms at Strategy Analytics, said: “Samsung’s smart TV market leadership gives it a great foundation to sustain Tizen as the leading TV streaming platform for years to come. However several other major players are also growing rapidly and many have the resources to build a serious challenge to Samsung if the strategic ambition is there.”

David Mercer, VP and Principal Analyst, added: “The transition to global internet-based television and video services during this decade will be enabled by smart TV systems controlled by a few leading technology vendors. As streaming on TVs becomes the preferred video viewing behaviour, content providers will rely increasingly on the UI, analytics, advertising and content discovery capabilities of connected TV platforms and the firms controlling them.

“As we are seeing in smartphones today, we envisage strategic conflicts eventually emerging between content and TV streaming platforms which will raise challenging structural and regulatory questions.”

The report adds that the overwhelming majority of the market is controlled by ‘Others’ at 43.9%. This is likely due to low-cost brands in developing markets, and in China where brands such as Amazon and Google are not allowed to do business.