After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

OTT TV value ‘yet to convince’ South-East Asia users

The value of OTT TV services has yet to fully convince viewers in key south-east Asian markets to sign up, according to research carried out by YouGov for Brightcove.

According to the Asia OTT Television Research Report 2018, which covers India, Thailand, Indonesia, Hong Kong and Singapore, OTT TV consumers in the region are highly price-sensitive compared with pay TV, with free and pirate sites presenting a significant competitive threat to premium services.

The research found that while advertising-funded services can be viable, tolerance is limited to between one and three ads in a single commercial break.

The research found that while advertising-funded services can be viable, tolerance is limited to between one and three ads in a single commercial break.

Up to 40% of consumers said they spend one to five hours a week watching content, while up to 27% said they spend six to 10 hours. The report also found that in emerging markets like India, Indonesia, and Thailand, which are mobile-centric, consumers watch more TV than in mature markets like Singapore and Hong Kong.

According to the report, up to 73% said they preferred to watch content on free-to-air (FTA) broadcast channels, the main vehicles for local content in the region, while some preferred pay TV channels and free online streaming services.

Up to 44% of consumers said that free online streaming sites were their preferred platform for movie watching, with illegal free online streaming services forming one of the main barriers to OTT adoption.

In Singapore and Hong Kong, laptops, smartphones, and tablets are the most commonly used platforms to watch TV, whereas in Indonesia, India, and Thailand, Smart TVs and smartphones are preferred.

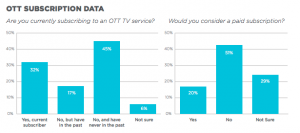

Thirty-two percent of consumers polled said they were current OTT subscribers, whereas 17% said they were past subscribers without an active subscription currently. Some 50% of the latter said they would consider re-subscribing to an OTT service, while only 24% of those who had never subscribed said they would consider signing up.

Of the 45% of people who have never subscribed to an online streaming service, 51% said they would not consider changing their mind, with the availability of free content and the perception that pay services either offer no value or are too expensive driving resistance.

There were some variations between markets. In India, ad-funded, pay TV and OTT subscription options are highly preferred payment option for TV shows, movies and sports. India also had a much higher amount of consumers who said paying for content is also a family decision. Thai consumers strongly prefer free or ad-funded platforms.