After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Deloitte: UK TV viewing by 18-24 year-olds to drop by up to 15% in 2018

Traditional TV viewing among 18-24 year olds in the UK will fall by 10%-15% in 2018 and 2019 but the rate of decline may slow after this, according to new research by Deloitte.

The UK media sector trends report mooted a ‘Great British switch off’ among younger viewers as demand for paid-for online media content continues to grow.

The UK media sector trends report mooted a ‘Great British switch off’ among younger viewers as demand for paid-for online media content continues to grow.

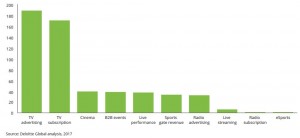

However, live broadcast and events are tipped to continue to thrive in a digital world, generating £400 billion globally and £24bn in the UK in 2018. Globally, 98.5% of this revenue will be generated by what Deloitte termed “traditional forms of media”, including television, cinema, sports events, live music and theatre performances.

“Many forces that distracted young people away from traditional TV, such as smartphones, social media and video piracy, have peaked,” said Paul Lee, head of research for technology, media and telecommunications at Deloitte

“Digital distractions will remain, but their impact is unlikely to increase further. Nevertheless, broadcasters, distributors and advertisers have to react to changing consumer habits. To this end, measurement’s scope will need to expand to include reactions to viewing, as well as minutes viewed.”

Deloitte said that by the end of 2018, half of adults in developed countries will have at least two online-only media subscriptions, paying for TV, music, news or video games services. It expects this to double to four by 2020.

In 2018 it tips there to be 350 million digital-only subscribers globally and around 580 million subscriptions to services. In the UK Deloitte estimates there are about 26 million online-only subscriptions.

“The growing adoption of digital-only subscriptions is a clear indication of consumers showing increasing willingness to pay for content online, rather than relying on ad-funded media only,” said Dan Ison, partner and head of media and entertainment at Deloitte.

Worldwide, the report predicts that live TV and radio broadcasting will account for 72% live revenues in 2018, with broadcast TV revenue alone accounting for £265 billion through advertising and subscriptions.