After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Western Europe ‘safe from cord cutting’ for next five years

The Western European pay TV market will avoid “the curse of cord-cutting” and still gain subscribers between 2016 and 2022, according to new research.

The Western European pay TV market will avoid “the curse of cord-cutting” and still gain subscribers between 2016 and 2022, according to new research.

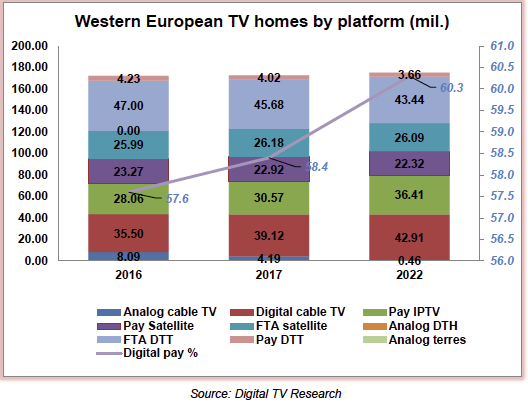

The Digital TV Research report predicts that Western Europe will cross the 100 million pay TV subscriber mark in June this year and climb to 106 million in 2022.

Overall, between 2016 and 2022, the research estimates that there will be a 6.7% increase in pay TV subscribers in the region – a gain of nearly seven million customers.

“Better news is that the number of digital pay TV subscribers will increase by 15.6% (14 million) over the same period. Analogue cable subs will fall from 8.0 million in 2016 to 0.5 million in 2022,” said Digital TV Research principal analyst, Simon Murray.

The report claims that much of the subscriber growth will come from countries with “traditionally low pay TV penetration”, with two-thirds of the region’s net additions to come from Italy, Spain and France.

Italy is expected to add 1.47 million pay TV subscribers between 2016 and 2022, Spain 1.36 million and France 1.41 million.

IPTV is tipped to add more than 8 million subscribers between 2016 and 2022 and digital cable is expected to gain 7.4 million subscribers – though this will be almost entirely offset by analogue cable losses.

Pay satellite TV is expected to lose nearly 1 million subscribers and pay DTT to lose 567,000 subscribers.

Despite an overall increase in pay TV homes, pay TV revenues are expected to remain flat at around US$28 billion.

“Liberty Global, Sky and Vodafone will together account for 42% of the region’s pay TV subscribers by 2022,” according to the report. “The same companies will take 53% of pay TV revenues.”