After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Interview: Starz Play Arabia CEO Maaz Sheikh

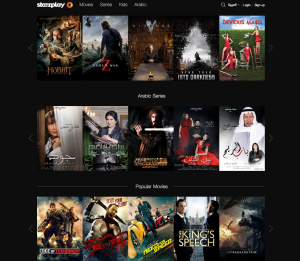

Starz Play Arabia has carved out place in the MENA video market and has its sights set on further growth, CEO Maaz Sheikh tells Andy McDonald.

Starz Play Arabia first appeared last year offering subscription video-on-demand in the still nascent Middle East and North African over-the-top market. Born out of a partnership between US-listed Starz and Parsifal Entertainment Group, the release marked the first international SVOD move by Starz, and after a soft launch last summer the service fully went live across the region early in 2016.

Operated by Dubai-based start-up Playco Entertainment, Starz Play Arabia provides an alternative to TV providers like OSN and beIN. However, CEO and co-founder Maaz Sheikh does not believe it is competing directly with these traditional players. “I don’t think we are cannibalising or eating into the traditional pay TV share. I think this is a segment of the market that either could never afford a pay TV or was never marketed a traditional pay TV because of their age.”

Speaking to DTVE ahead of this week’s TV Connect MENA event, Sheikh explains that Starz Play Arabia’s age demographics are pretty consistent across the region. “Our biggest segment is 18-24 year-olds, followed by 24-34 year-olds,” he says, claiming that for people at the younger-end of this age range there is an “affordability issue” in paying US$100 (€90) per-month for a full pay TV package. “I think also the younger segment does not relate to linear channels and traditional broadcasts like they do to on-demand”.

Sheikh, who co-founded Starz Play, having previously worked for OSN, believes that “much more of a permanent shift” is occurring in young people’s viewing habits. Thinking of his own teenage children he says: “I don’t think they’ll ever go to watching linear television.”

Starz Play viewing is roughly split between mobiles and big screens and in North Africa and Suadi Arabia Sheikh claims as much as 70%-80% of consumption is happening on mobile.

Starz Play is providing these viewers with new viewing options, but it is not the only company to do so. Icflix is another SVOD provider that is operating in this region, while in January Netflix announced its move into 130 new countries – a move that gave it near-global coverage, barring China, and saw it enter the MENA region for the first time.

Netflix rivalry

“While initially alarming for us as a startup player compared with a globally established brand like Netflix, what we realised very quickly is that overall it’s been a very positive step for us,” says Sheikh. “It definitely brought a lot more recognition to this category overall. We started to see traffic and app downloads increase for our service when Netflix started to do its own marketing.”

Another benefit Sheikh identifies was Netflix’s decision to clamp down on VPN access to its service – a move that came on the heels of its global expansion efforts. This meant that local customers were made to access the Netflix  catalogue designated to a particular market – which in the case of MENA and many other regions was not as extensive as its US content offering.

catalogue designated to a particular market – which in the case of MENA and many other regions was not as extensive as its US content offering.

People at that point were able to compare Starz Play and Netflix side-by-side, says Sheikh, who claims that Starz “stood out in terms of the premium nature of the content as well as the volume of the content.”

Sheikh won’t reveal Starz Play’s subscriber numbers but he says that the service is now available in 19 countries in MENA and has been growing 25% month-on-month since the start of the year. “On a daily basis, for example in the month of September, we almost averaged a million visits a day to our website in the region – and it’s growing.”

In terms of content there has also been strong development. “On the Hollywood side we have exclusive rights to movies in the pay window. For example we have a pay movie rights deal with Disney, with Sony, with Warner and with MGM,” says Sheikh. “Besides that we have first-run exclusive series from several studios as well, including CBS, Showtime and our own original series from Starz. The combination of recent movies and first-run and exclusive series makes us a pretty powerful service offering.”

Starz Play also carries over 3,000 hours of French content, targeted at its partners in North Africa, and during Ramadan this year added to this an Arabic offering with more than 1,100 hours of Arabic series – including four series that are available day-and-date with their linear release. “You have several hundred free-to-air channels, a lot of Arabic content available online for free including YouTube, so you have to deliver a value proposition on Arabic where customers see the value in paying your monthly service charge,” says Sheikh.

International expansion

Starz Play already works with operators across the MENA region – a move that promises to both help the service to grow and that tailors it to appeal to more directly to specific markets. Sheikh says that Saudi Telecom, for example, requests “edited content that is safe for families – that’s how they would like to partner with us.”

Ooredoo in Tunisia, by contrast is focused very heavily on a French Starz Play offering.

“The Middle East and North Africa market is 380 million Arabic-speaking people, but there’s a fair amount of diversity within these countries. From Muscat to Marrakesh there’s a big amount of variability in terms of language, ethnic breakdown, as well as content preferences and definitely the service is personalised and curated for each market,” says Sheikh.

Next up are plans by Starz Play to move outside of the Middle East and North Africa as part of a major 2017 expansion plan. Sheikh says that the company plans to bring Starz Play to Sub-Saharan Africa and Asia next year, targeting specific countries, rather than launching a Pan-Asian or Pan-African offering.

“We’re not looking to go into South Africa, but we’re looking at Sub-Saharan Africa. Within Sub-Saharan Africa we’re looking at the English-speaking block of countries and within that we are trying to zero in on select countries and markets,” he says.

In Asia Sheikh said Starz Play would look to launch in select countries where there is space to grow the SVOD market and where competition is not already overly high from Netflix and local operators. He added that talks with partners are already underway and that more specific details will follow next year.

Asked about whether Starz Play would also move into Europe, Sheikh claims that there are no plans for this – “at least in the immediate future”. He says: “We think, for us, given where we are in Dubai, we see some low-hanging fruit in markets next door to us. We prefer to focus on these markets – at least for the next two years.”

Recent research from Digital TV Research predicts that the MENA region will have 19.59 million paying subscription video-on-demand subscribers by 2021, and that Starz Play will account for 1.39 million of these, or 7.1% of the market. However with a wider international footprint the service looks set to grow even further in the coming years as the OTT market as a whole matures.